Evaluation of an Entity’s Ability to Continue as a Going Concern

In August 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2014-15, Going Concern. As a result of this ASU, management is now required to prepare and to document the analysis of whether they believe there is substantial doubt about the entity’s ability to continue as a going concern. However, the auditor’s responsibility remains unchanged. Just because management determines there is no going concern issue doesn’t mean the auditor will concur as they will need to ‘audit’ the analysis.

Under generally accepted accounting principles (GAAP), continuation of a reporting entity as a going concern is presumed as the basis for preparing financial statements unless the entity’s liquidation becomes imminent, in which case the financial statements are prepared on a liquidation basis. However, even if liquidation is not imminent, there may be conditions or events that raise substantial doubt about an entity’s ability to continue as a going concern.

The going concern analysis considers various facets of an entity’s business and is subjective based on the facts and circumstances. This ASU is effective for annual periods ending after December 15, 2016, fiscal year end June 30, 2017, and early adoption is permitted.

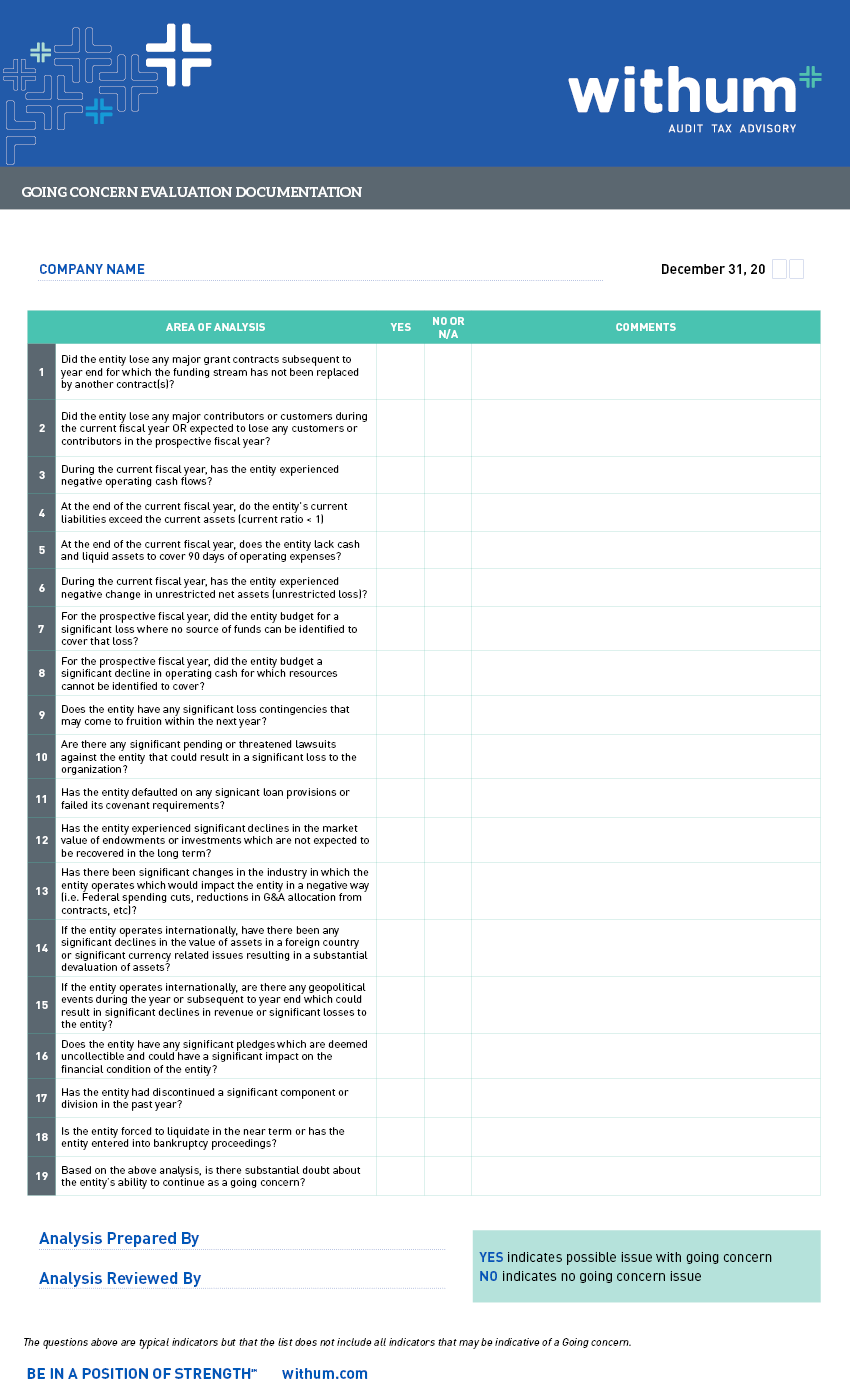

Download the following checklist. It can be used by management and the board of directors as a guide to evaluate and document an entity’s ability to continue as a going concern:

After completing the analysis and determining that there is substantial doubt, management must then analyze if there are mitigating factors which alleviate the doubt about the entity’s ability to continue as a going concern. If, after considering all mitigating factors, substantial doubt about the entity’s ability to continue as a going concern remains, management is required to disclose that fact that and the reasons giving rise to such doubt.

If you have questions or comments about evaluating this issue, please feel free to reach out to us.

Need More Information?

If you have any questions about this not-for-profit update, please contact your Withum professional, a member of Withum’s Not-for-Profit & Education Services Group or email us at [email protected].

Not-For-Profit News Group

Join Now Via LinkedIn!

Ask Our Experts

The information contained herein is not necessarily all inclusive, does not constitute legal or any other advice, and should not be relied upon without first consulting with appropriate qualified professionals for your individual facts and circumstances.