This article is the first of two providing a tax policy comparison of Kamala Harris and Donald Trump, which aims to provide an unbiased and balanced perspective. We strive to present factual information and avoid any partisan bias. Our goal is to inform readers by highlighting the key aspects of each policy, allowing them to form their own opinions based on accurate and comprehensive data. We do not endorse or oppose any political figure or party. Our commitment is to neutrality and fairness, ensuring that our analysis is objective and based solely on the policies themselves.

With the Presidential election less than one month away, private and family-owned businesses are in limbo when dealing with 2024 year-end tax planning. While President Trump has campaigned with the promise to extend the individual provisions in the Tax Cuts and Jobs Act (TCJA), including individual income tax rates and the 20% 199A business deduction for pass-through entities, Vice President Kamala Harris’s tax policy has yet to be ironed out.

Harris announced a limited tax plan in her new tax and economic policies as part of her campaign platform, including expanding the child tax credit, making the expanded premium tax credits permanent, new incentives for housing, and exempting tip income. However, the individual income tax policies that could increase pass-through owners’ federal income tax by over 30% are still undefined. As no alternative policy has been provided by the Harris campaign, Democrats will likely turn to some of the revenue proposals in the Build Back Better Act and the 2024 Fiscal Year Budget provided by the Biden-Harris Administration.

Individual Income Tax Rates

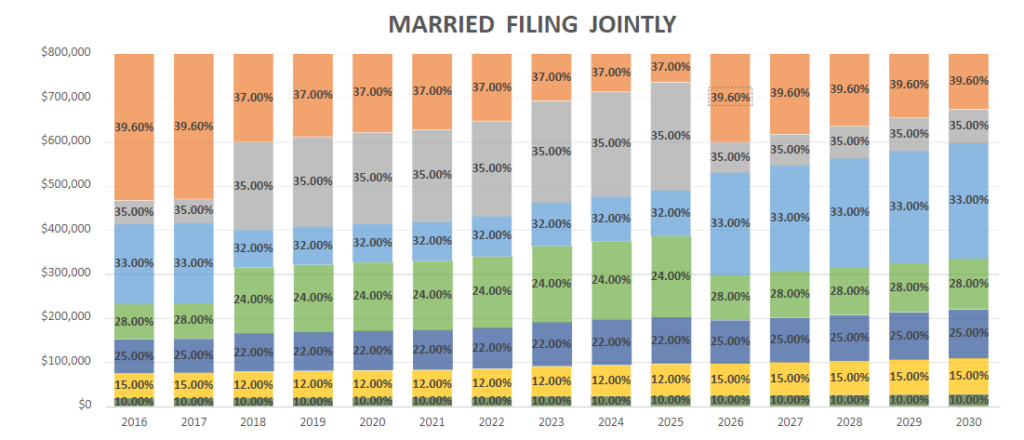

As many voters know, the Harris campaign policy for individual income tax supports increasing the top federal income tax rate from 37% to 39.6%. However, it is incorrect to assume that taxpayers who are currently paying an effective tax rate of less than 37% will not see a change in their federal income tax due. The reversions back to inflation-adjusted pre-TCJA tax rates for individual taxpayers include the adjustment of various income tax brackets.

Using the inflation-adjusted pre-TCJA tax rates, a married filing joint couple with taxable income of $110,000 in the 2024 taxable year will pay federal income taxes of approximately $12,928. In 2026 the same couple with that same taxable income of $110,000 will see their federal tax bill grow to $15,013, or approximately $2,000 or 16%. While the increase goes against the campaign policy to avoid raising taxes on taxpayers with taxable income under $400,000, no further information has been provided by the Harris campaign on how the tax system would be adjusted to ensure that statement holds true.

A married filing joint couple with $500,000 of taxable income in the 2024 taxable year will pay federal income taxes of approximately $114,000; however, the same couple in 2026, assuming pre-TCJA brackets were adjusted with historical inflation rates, will pay federal tax of $132,000, for an increase of over $18,000 or 16%.

Tax policy advisors will often reference the Build Back Better presented by Democrats in 2021 as the base for future Democrat tax legislation. The Build Back Better plan was unable to move through the budget reconciliation process, but it still provides some insight into Democratic tax policy. To ensure federal income taxes would not increase on taxpayers with taxable income less than $400,000, the Democratic proposal would apply the 39.6% rate to married filing joint couples with taxable income over $450,000 ($400,000 for single taxpayers). If the Build Back Better plan is followed, this would likely grow individual federal income tax rate increases for taxpayers making $400,000 or more of taxable income.

199A Pass-Through Deduction

For many owners of private and family-owned partnerships, S corporation shareholders, and entrepreneurs, receiving the 199A pass-through deduction is essential for competition, expanding the employee workforce, and funding of capital improvements. However, the conclusion that must be drawn from the Harris campaign’s statement that they support TCJA expiring provisions and pledge not to raise taxes on taxpayers with taxable income of less than $400,000 would conclude that the 199A deduction will no longer be available for many pass-through entity owners.

It remains unclear how or if 199A will continue based on the Harris campaign tax policy provided at this time. If the Build Back Better proposal is followed, a maximum 199A deduction would still be allowed but capped based on filing status and the amount of qualified business income received from the pass-through.

| Build Back Better (2021) | Maximum 199A | Maximum QBI |

|---|---|---|

| MJF, SS | $500,000 | $2,500,000 |

| HH, Single | $400,000 | $2,000,000 |

| MFS | $250,000 | $1,250,000 |

| Estate or Trust | $10,000 | $50,000 |

However, an alternative proposal was presented in July of 2021 by Senator Wyden, the current chair of the Senate Finance Committee. Under that proposal, the 199A deduction would start to phase out for taxpayers with taxable income above $400,000 and be eliminated if a taxpayer’s taxable income exceeded $500,000. Coupled with the individual income tax rate increase this could cause pass through entity owners who have total taxable income exceeding 400,000 to have an effective tax rate increase from approximately 30% to 39.6%.

Get the Latest Tax and Legislative Developments

Withum’s National Tax Policy and Legislative Updates Resource Center is the go-to hub for the latest changes in tax laws and legislative developments from Washington, D.C. Our team closely monitors and analyzes proposed tax legislation, providing individuals and businesses with timely insights to help navigate the evolving tax landscape.

Capital Gains and Net Investment Income Tax Rates

Under current law, the maximum federal tax rate for long-term capital gains and qualified dividends is 20%. An additional net investment income tax of 3.8% can apply if the long-term capital gain is derived from a trade or business that is considered to be a passive activity or if it is qualifying dividend income.

Under the Biden-Harris 2024 fiscal year budget proposal, the long-term capital gains and qualified dividends tax rate would be increased to ordinary income tax rates, potentially up to 39.6%, for taxpayers with taxable income above $1 million. Coupled with this is a proposal that net investment income tax rates rise from 3.8% to 5% for taxpayers with taxable income above $400,000.

Vice President Kamala Harris announced a deviation from the 2024 fiscal year budget proposal during her economic speech in New Hampshire back in September. She announced a 28% cap on the maximum long-term rate for taxpayers with taxable income above $1 million. However, the proposed Net Investment Income Tax increase would appear to remain at 5% for taxpayers with taxable income above $400,000 as no modification was discussed.

Taxable Income Over $400,000 but Below $583,751

| Married Filing Jointly | 2024 | Harris Proposal |

|---|---|---|

| Capital Gains Tax Rate | 15% | 15% |

| Net Investment Income Tax | 3.8% | 5% |

Taxable Income Over $583,751 but Below $1,000,000

| Married Filing Jointly | 2024 | Harris Proposal |

|---|---|---|

| Capital Gains Tax Rate | 20% | 20% |

| Net Investment Income Tax | 3.8% | 5% |

Taxable Income Over $1,000,000

| Married Filing Jointly | 2024 | Harris Proposal |

|---|---|---|

| Capital Gains Tax Rate | 20% | 28% |

| Net Investment Income Tax | 3.8% | 5% |

Applicability of Alternative Minimum Tax (AMT)

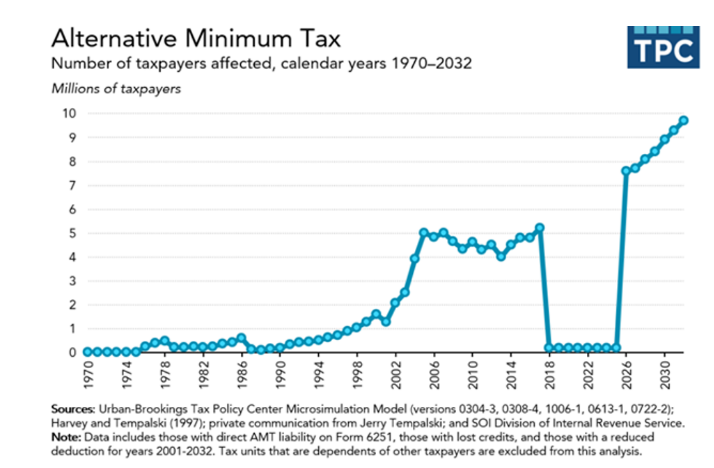

As the Harris campaign generally supports not extending the sunsetting TCJA provisions, AMT phase-out thresholds and exemption amounts are presumed to revert to pre-TCJA levels. The Tax Policy Center estimates that only 200,000 individuals are currently subject to AMT, but this number will increase to 7.6 million in 2026 and, ultimately, 9.7 million in 2032.

The dramatic increase in AMT applicability is due to the reversion back to pre-TCJA phase-out and exemption amounts. In 2023, a married filing jointly taxpayer would not have AMT provided AMT tax did not exceed the exemption amount of $126,500, and their AMT income was less than $1,156,300. Alternatively, if pre-TCJA amounts are reinstated, the taxpayer exemption amount is decreased back to $84,500 and their AMT income cannot exceed $160,900. As many taxpayers will exceed the pre-TCJA exemption phase-out threshold of $160,900, their exemption amount of $84,500 will decrease and will be eliminated if AMT income exceeds $498,900.

| MFJ | 2023 | 2017: Pre-TCJA |

|---|---|---|

| AMT Exemption Phaseout Threshold | $1,156,300 | $160,900 |

| Exemption Amount | $126,500 | $84,500 |

While certain state Pass-Through Entity Tax regimes may allow pass-through owners to decrease or avoid AMT tax, W-2 wage earners will be unable to avoid AMT applicability.

While the Harris proposal reflects that individual and pass-through business owners with a total taxable income of $400,000 or more will be subject to a federal income tax rate increase and larger federal cash tax payments, but the extent of the increase remains unclear. Withum’s National Tax Services Professionals will continue monitoring how individuals and pass-through entity owners will be impacted as more details of the Harris tax policy is confirmed.

This article was originally published by Lynn Mucenski-Keck in Forbes on October 9, 2024.

Tune In!

Listen to our Taxing Topics: Navigating Election Year Podcast Series! In this episode, we take a closer look at Vice President Kamala Harris’s ambitious tax proposal. Learn about the potential economic impacts, the changes to capital gains taxes, and how these policies could shape the future of the American tax system.

Contact Us

For more information on this topic, please contact a member of Withum’s Business Tax Services Team.