Many questions have surfaced amongst auto dealerships regarding seller and transfer reports and how to properly report them on the IRS Energy Credit Online Portal. While the roll-out of the portal has been bumpy, the Internal Revenue Service (“IRS”) is working through the problem areas as they are presented. The updated IRS guidance regarding these items as of January 8, 2024, is highlighted below.

IRS Guidance Highlights

2023 Seller Reports

Dealers who sold new and used qualified clean vehicles in 2023 were required to submit a seller’s report to the customer at the time of the sale in order for the vehicle to be deemed qualified for the federal clean vehicle income tax credit. In addition to providing the customers with a sales report at the time of sale, dealers must also summarize and submit the required information to the IRS. The original deadline for a dealer to submit their 2023 new and used qualified clean vehicle sellers report was January 15, 2024, but the IRS has just announced a deadline extension to January 31, 2024.

The IRS prefers that the 2023 seller report be provided in one Excel spreadsheet, including all required data from qualified used and new clean vehicle 2023 sales. Alternatively, dealers can either choose to submit each Form 15400 (Clean Vehicle Seller Report) provided to customers for 2023 sales or any reasonable alternatives to Form 15400 (including the NADA sample seller documents). Dealers should submit their 2023 seller reports to the IRS by email using the following email address: [email protected].

The process outlined by the IRS appears to raise possible privacy and data security concerns because it involves the submission of documents containing sensitive customer data to a potentially unsecure IRS email address.

The IRS is aware of this issue, and we are awaiting further guidance. We recommend not filing the 2023 seller report until additional IRS guidance is issued.

If a dealership sold a new or used clean vehicle in 2023 but did not provide the 2023 seller report to their customers at the time of sale, dealers should work judiciously to provide the seller’s report to their customers as soon as possible, documenting any communication. For example, a dealership could mail Form 15400 (Clean Vehicle Seller Report) or the NADA sample seller document via certified mail to the customer’s most recent known mailing address.

While many dealerships may feel overwhelmed with the various compliance requirements for new or used qualified clean vehicles, it is important they do their best to comply. IRS Revenue Procedure 2023-33 clearly states that a dealership’s eligibility to transfer EV credits may be suspended to the extent the dealer fails to follow the tax compliance requirements, including submitting seller reports.If dealerships do not comply with the various compliance requirements, they could lose a competitive advantage in transferring federal clean vehicle credits at the time of sale (instead, requiring customers to wait until they file their individual income tax returns to claim the credit).

2024 Seller Reports

Seller reports for new or used qualified clean vehicles should be provided to customers at the time of sale and submitted to the IRS within three days of sale. For 2024, a year-end summary seller report will not be required as they are submitted regularly during the year.

On Friday, January 5, the IRS released guidance postponing the 2024 seller report for sales between January 1 through 16. Due to some technical glitches with the IRS Energy Credit Online Portal, the 3-day deadline has been extended, and all new and used clean vehicle sales between January 1 and 16 are not due until January 19.

The IRS also opened additional office hours for assistance with seller reports. They are as follows:

| January 9, 2024 | 2:00 – 2:30 PM EST | Register Here |

| January 10, 2024 | 2:00 – 2:30 PM EST | Register Here |

| January 11, 2024 | 2:00 – 2:30 PM EST | Register Here |

| January 16, 2024 | 2:00 – 2:30 PM EST | Register Here |

| January 17, 2024 | 2:00 – 2:30 PM EST | Register Here |

| January 18, 2024 | 2:00 – 2:30 PM EST | Register Here |

IRS Energy Credit Online Portal

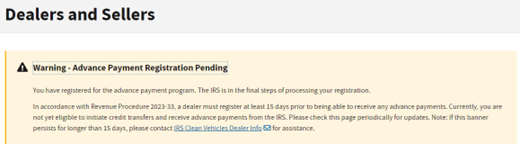

All auto dealers should understand two registration processes are required in the portal, one for seller reports and one for advanced payments (transfers). While many dealerships were previously approved for the seller reports, complications may have arisen when registering for advance payment reports, including the Portal indicating that registration is pending.

Dealers can be approved for issuance of seller reports while their registration to receive advance payments remain pending. In this situation, the dealer cannot conduct credit transfer transactions until the advance payment registration process is complete but can issue seller reports if buyers wish to purchase the vehicle and claim the credit on their taxes later without transferring the credit.

The IRS is still working through the backlog of registrations that are pending. To the extent that the dealer is receiving a pending notice regarding registration, there is nothing more for the dealer to do at this time. The dealer will be notified by the IRS when the registration is complete. Once registered for advanced payments, the dealer may engage in the credit transfer process.

Any problems encountered during or questions about the registration process should be directed to the IRS via the help desk email at [email protected].

Contact Us

For more information on this topic, contact Withum’s Dealership Services Team.