In a blockbuster three-team trade, the Los Angeles Lakers landed Luka Dončić from the Mavericks, while Anthony Davis headlined the package going to Dallas, with several other players and picks also involved in the deal. This trade has sparked significant debate, as the Mavericks part ways with one of the league’s premier talents. At just twenty-five, Dončić has already built an impressive résumé, including an NBA Rookie of the Year award, multiple All-Star and All-NBA First Team selections, and the 2023-24 scoring title. Meanwhile, Davis brings championship experience and elite defensive ability to a Mavericks team looking for veteran leadership.

Beyond basketball, this move has major financial implications for Dončić. By leaving Dallas, he forfeits his eligibility for a five-year, $345 million supermax contract—an exclusive NBA incentive reserved for players who re-sign with their original teams. This deal would have set a new league record, surpassing Jayson Tatum’s $315 million extension in July 2024. Now, Dončić must continue proving his worth with a legacy franchise like the Lakers to secure a similar payday in the future.

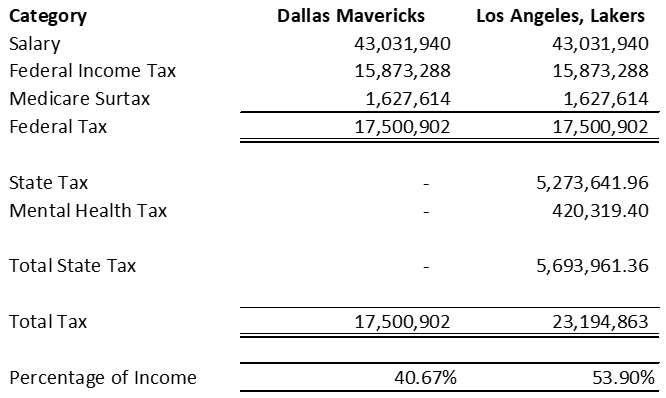

The trade also has significant tax implications. Dončić’s salary places him in the highest federal tax bracket of 37%, along with an additional 3.8% Medicare surtax on adjusted gross income exceeding $200,000. However, the biggest financial impact comes from state taxes. California has the highest state income tax in the U.S. at 12.3%, plus a 1% Mental Health Services tax on incomes over $1 million. Compared to Texas, which has no state income tax, this represents one of the most drastic financial shifts in league history.

While Luka Dončić faces an approximate 13% loss in income due to California’s high state taxes, Anthony Davis enjoys a comparable financial advantage by moving to the tax-free Texas with the Dallas Mavericks. Though this trade may be remembered as one of the most debated in NBA history, only time will tell if Dončić continues his remarkable career trajectory.

Navigating the complexities of state and local tax laws is crucial for professional athletes, especially when facing significant financial shifts. Having a knowledgeable accountant can make all the difference in preparing for these changes. At Withum, we specialize in providing expert guidance to help athletes optimize their financial strategies.

Authors: Spencer Anapol | [email protected] and Evan Graulau | [email protected]

Contact Us

For more information on this topic, please contact a member of Withum’s Professional Sports Services Team.