Doing business through a partnership has many benefits, such as allowing for a pass-through (conduit) regime of taxation and great flexibility in allocating profit and loss among the partners. Liabilities under the aggregate concept of partnership taxation are included in the partners outside basis of its interest. Internal Revenue Code (IRC) Section 752 accomplishes this by treating changes in the partnership’s liabilities as deemed contributions and distributions to and from the partnership. This is important as it allows the partnership to allocate losses and make distributions to its partners if these amounts do not exceed the partner’s basis in its interests .

This article will provide an overview of recourse and nonrecourse liabilities and how to properly allocate each type of debt among the partners in a partnership. In the context of a partner’s basis in its interest in a partnership, there are two seminal court cases worth mentioning: Crane v. Commissioner, 331 U.S. 1 (1947) and Commissioner v. Tufts, 461 U.S. 300 (1983). These cases provide the foundation for including debt in a partner’s basis. The Crane case concluded that when borrowed funds are used to invest in property, the partners are given basis for these borrowed funds. Tufts reaffirms this conclusion and goes on to find that when property is sold or transferred subject to a nonrecourse liability which exceeds the property’s tax basis, the debtor must include in income the amount equal to the difference. The regulatory provisions and concepts of partnership minimum gain and minimum gain chargeback simply require partners who are allocated nonrecourse deductions to report an offsetting amount of income or gain when the partnership disposes of the property.

Allocation of Recourse Debt

A partnership liability is considered recourse to the extent that any partner (or related person) bears the economic risk of loss associated with that liability. Treasury Regulation §1.752-2(a) and (b) provide the rules for allocating recourse debt. A partner bears the economic risk of loss of a liability to the extent that if the partnership were to constructively liquidate, those partners that would ultimately be obligated to repay the liability (considering all contractual obligations, guarantees, and indemnifications) would be allocated the debt. Upon a constructive liquidation, the following events are deemed to occur simultaneously:

- All partnership liabilities become payable in full

- All partnership assets become worthless

- All partnership property is disposed of for no consideration except relief from nonrecourse liabilities

- All items of income, gain, and loss are allocated among the partners

- The partnership liquidates

In practice, this hypothetical scenario is commonly referred to as the “atom bomb test” as it foresees the partnership to look at the worst-case situation where the partnership liquidates at a time when all its assets, including cash, have zero value. It forces a partnership to determine which partner(s) will be responsible for satisfying the liabilities.

Example – Allocation of Recourse Debt

A, B, and C form an equal partnership in which A and B each contribute $1,000 cash, and C contributes property worth $10,000 subject to a $9,000 recourse loan to partner C. No member shall be obligated to make additional capital contributions in excess of its initial capital contributions.

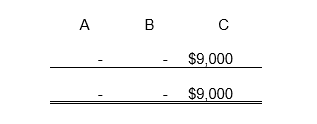

The allocation of the $9,000 of recourse liabilities is as follows:

In the above example, in determining the allocation of the recourse liabilities under the constructive liquidation principals, 1) the mortgage in the amount of $9,000 is deemed to be due and payable in full, 2) the cash of $2,000 is deemed worthless (forcing us to only look at the property secured by the liability), 3) the property is disposed for no consideration resulting in a $10,000 loss to the partnership, 4) the tax year ends and the $10,000 loss is allocated to the partners — first, $1,000 to partners A, B, and C to reduce their capital accounts to zero (pursuant to the operating agreement) and second, the remaining $7,000 to partner C (who guaranteed the debt), and 5) the partnership liquidates. In this example, the $9,000 of recourse debt is allocated to Partner C, who bears all economic risk of loss. Said another way, partner C would ultimately be responsible for contributing $7,000 (along with the $2,000 of cash on hand from partners A and B’s contributions) to settle the partnership liability.

Allocation of Nonrecourse Debt

A partnership liability is considered nonrecourse to the extent that no partner (or related person) bears the economic risk of loss associated with that liability. Nonrecourse debt of a limited liability company commonly includes accounts payable, accrued expenses, notes payable, and secured mortgages. Treasury Regulations §1.752-3(a)(1) through (3) provide the rules for allocating nonrecourse debt. Pursuant to these regulations, a partner’s share of nonrecourse liabilities equals the sum of its share of 1) §704(b) partnership minimum gain, 2) §704(c) minimum gain, and 3) excess nonrecourse liabilities.

Pursuant to Treasury Regulation §1.752-3(a)(1), a partner’s share of partnership minimum gain is determined in accordance with the rules of §704(b) and the treasury regulations thereunder. This will only apply if the partnership owns depreciable assets securing the nonrecourse liability. Partnership minimum gain can be thought of as the minimum gain that the partnership would realize were it to make a taxable disposition of the depreciable property secured by nonrecourse financing (the Tuft Case). This is the difference between the IRC §704(b) basis of the assets and the secured debt. The book and tax basis for real property contributed is often the same, but variances between 704(b) and tax basis can occur during a revaluation event. Essentially, if the nonrecourse debt on depreciable property is less than the basis of the depreciable property securing it, no partnership minimum gain would be recognized. This first amount or tier ensures there is enough outside basis to absorb allocated deductions and distributions.

The second allocation step occurs when a partner contributes appreciated property secured by a nonrecourse liability that has a FMV in excess of its book value at the time of contribution. Pursuant to Treasury Regulation §1.752-3(a)(2), a partner’s share of the §704(c) gain is the amount of any taxable gain that would be allocated to a partner under §704(c) if the partnership disposed of all property contributed subject to nonrecourse liabilities in full satisfaction of the liabilities for no other consideration. IRC §704(c) minimum gain is the comparison of the Section 704(c) basis of the secured property to the secured debt. This second amount or tier attempts to prevent the recognition of gains for those partners that have a difference in their 704(b) and tax capital accounts (i.e., through a property contribution or partnership revaluation).

Pursuant to Treasury Regulation 1.752-3(a)(3), a partner’s share of the excess nonrecourse liabilities is simply the balance of nonrecourse liabilities remaining after each partner has been allocated their share of those liabilities based on partnership minimum gain and 704(c) minimum gain. The regulations are very flexible in allocating this excess balance, and the method for doing so is generally stated in the partnership agreement.

Example – Allocation of Nonrecourse Debt

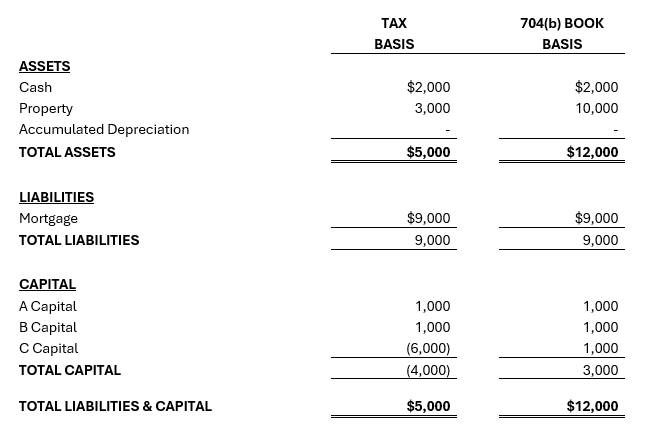

A, B, and C form an equal partnership to which A and B each contribute $1,000 cash, and C contributes property worth $10,000 subject to a $9,000 nonrecourse mortgage. C has a basis in the property of $3,000 immediately before the formation of the partnership. The §704(b) minimum gain does not apply as the partnership did not purchase depreciable property with a nonrecourse note. Instead, §704(c) will apply as partner C Contributed appreciated property secured by a nonrecourse note. Any remaining non-recourse liabilities would be allocated based on the partners’ profit-sharing ratios.

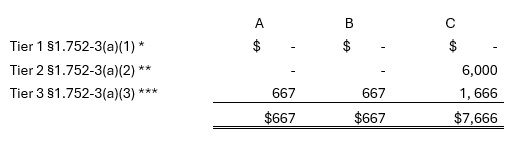

The allocation of the $9,000 nonrecourse liabilities is as follows:

*No §704(b) minimum gain as the §704(b) basis of the property exceeds the secured nonrecourse liability.

**§704(c) minimum gain as the secured nonrecourse liability exceeds the tax basis of the property ($9,000 – $3,000).

*** The remaining nonrecourse liability balance can first be allocated to the contributing partner to the extent of their remaining built-in gain ($7,000 – $6,000) and the remaining allocated to each partner based on their profit interest percentage ($2,000 x 33.33%) or allocated to each partner based on their profit interest percentage ($3,000 x 33.33%).

Qualified Nonrecourse Debt

Qualified nonrecourse debt is merely a sub-set of and allocated in the same manner as nonrecourse debt. The benefit of being classified as qualified nonrecourse debt (as opposed to nonrecourse debt) is that it provides partners with a risk basis to be able to deduct losses received. Qualified nonrecourse debt is defined in IRC Section 465(b)(6)(B) as:

- Borrowed by the taxpayer with respect to an activity of holding real property,

- Borrowed by the taxpayer from a qualified person or represents a loan from any Federal, State, or local government or instrumentality thereof, or is guaranteed by any Federal, State, or local government,

- Except to the extent provided in regulations, with respect to which no person is personally liable for repayment, and

- A liability that is not convertible debt.

Takeaways

The types and intricacies of allocating debt among partners are set forth in Treasury Regulation §1.752. The allocation of a partnership’s debt is important because a partner’s share of a partnership’s debt is included in the partner’s basis of its partnership interest. A partner’s basis in its partnership interest can determine the extent to which tax-free distributions can be received and the amount of loss the partnership can allocate to the partner.

Authors: Wyatt Chinn, CPA | [email protected] and Michael Hurwitz, CPA, Partner | [email protected]

Contact Us

If you need any assistance navigating these regulations and allocating partnership debt, reach out to Withum’s Real Estate Services Team.