Here we are; the PPP loan has come and gone. Are you one of the firms dealing with the repercussions of receiving PPP loan forgiveness? Hopefully, you properly accounted for PPP loan forgiveness in preparing your indirect cost rate. Otherwise, you will likely be hearing from your state department of transportation or other cognizant agency.

Per Federal Acquisition Regulation 31.201-5, the applicable portion of any income, rebate, allowance, or other credit relating to any allowable cost and received by or accruing to the contractor shall be credited to the Government either as a cost reduction or by cash refund.

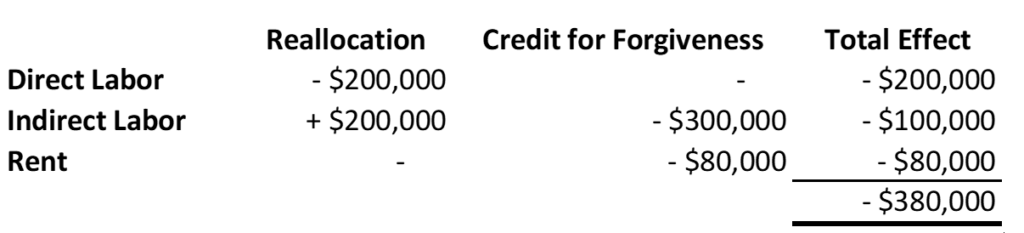

The first step in applying PPP loan forgiveness to the indirect cost rate is to identify the costs used when applying for forgiveness. These costs may or may not have included payroll, mortgage interest, rent and utilities and are the only costs that can be considered when applying loan forgiveness to your indirect cost rate. To minimize the impact, any forgiveness of PPP loans should be applied first to direct labor of commercial contracts. Thereafter, forgiveness could be applied to unallowable indirect costs, such as excess related-party rent, before being applied to allowable indirect costs. Any direct labor on government contracts must be reallocated to indirect costs for the indirect cost rate calculation.

Example of Effect of PPP Loan Forgiveness Facts

- PPP loan of $500,000, completely forgiven

- The $500,000 was spent on payroll ($400,000) and rent ($100,000)

- The $400,000 in payroll was $300,000 direct labor and $100,000 indirect labor

- The $300,000 in direct labor was $100,000 on commercial contracts and $200,000 on government contracts

- The $100,000 in rent included excess related-party rent of $20,000

- Given the facts above, the amount that is credited in the indirect rate calculation is $380,000 ($500,000 less $100,000 direct labor less $20,000 excess related party rent, an unallowable expense)

Adequate supporting documentation is a must. In terms of direct labor on commercial contracts, documentation should include job cost and labor distribution reports. The indirect cost rate adjusted for PPP loan forgiveness will be used for settle-up purposes only and will not impact funding on new contracts. Check out this article for more details on the NJDOT guidance on PPP loan forgiveness.

Contact Us

For questions or more information on this topic, contact a member of Withum’s Professional Services Team.