Single and Married Filing Separately

2024 DEDUCTION:

$14,600

2025 DEDUCTION:

$15,000

Married Filing Jointly and Surviving Spouses

2024 DEDUCTION:

$29,200

2025 DEDUCTION:

$30,000

Head of Household

2024 DEDUCTION:

$21,900

2025 DEDUCTION:

$22,500

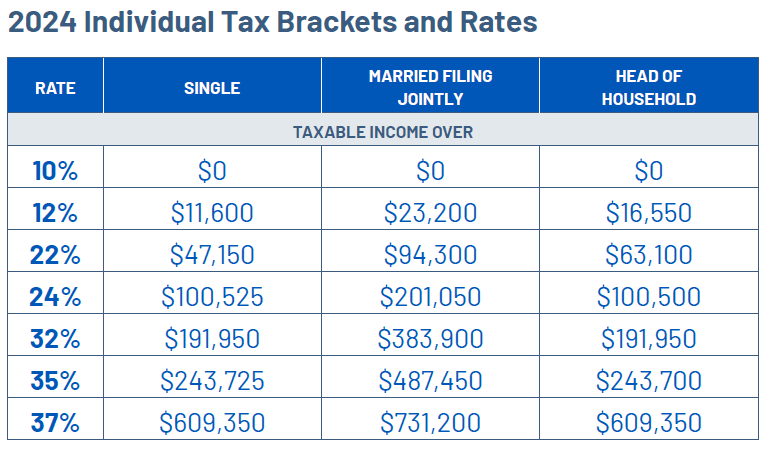

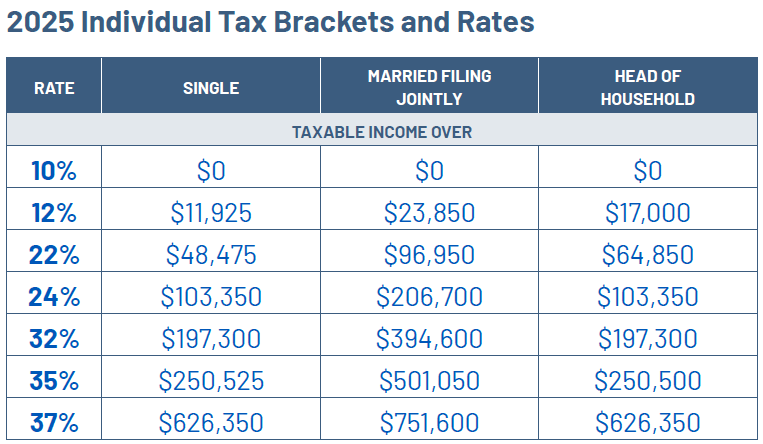

Individual Tax Brackets and Rates

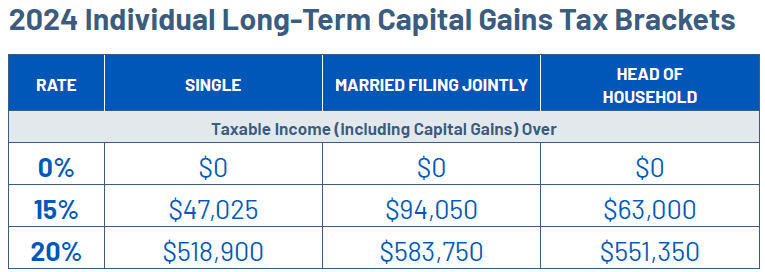

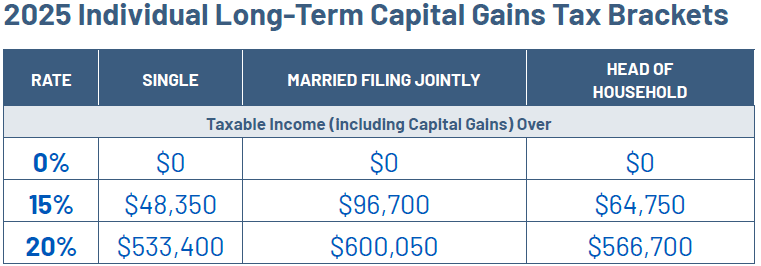

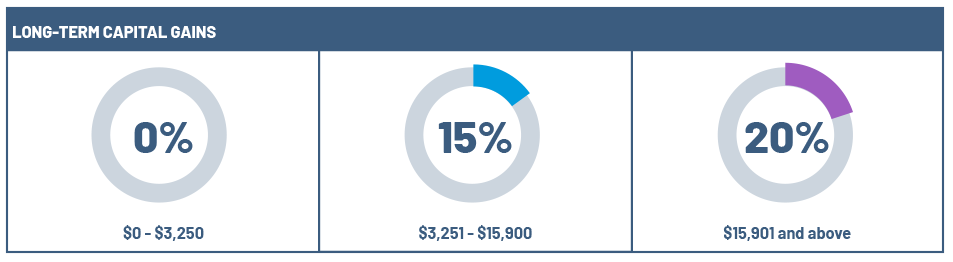

Individual Long-Term Capital Gains Tax Brackets

General Income Tax Planning

- Postpone income until 2025 and accelerate deductions into 2024.

- Doing so may enable you to claim larger deductions, credits, and other tax breaks for 2024 that are phased out over varying levels of adjusted gross income (AGI).

- Postponing income is also desirable for taxpayers who anticipate being in a lower tax bracket next year due to changed financial circumstances

- Long-term capital gain from sales of assets held for more than one year is taxed at 0%, 15% or 20%, depending on your taxable income. If you hold long-term, appreciated capital assets, and are in the 0% rate bracket, consider selling enough long-term assets to maximize the 0% rate in 2024.

- The 3.8% net investment income (NII) tax will apply depending on your modified adjusted gross income (MAGI) and NII for the year. You should consider ways to minimize or eliminate (e.g., through deferral) additional NII for the year, while trying to reduce MAGI other than NII.

- The 0.9% additional Medicare tax applies to individuals for whom the sum of their wages received with respect to employment and/or self-employment income exceeds a threshold amount ($250,000 for joint filers, $125,000 for married filing separately, and $200,000 in other cases). Employers must withhold the additional Medicare tax from wages in excess of $200,000, regardless of filing status or other income. Thus, you can minimize the additional Medicare tax by deferring income to 2025.

- Consider asking your employer to increase withholding of state and local taxes (or you can pay estimated state and local tax payments) before year-end to pull the deduction of those taxes into 2024. Remember that state and local tax deductions are limited to $10,000 per year until 2026, so this strategy is not a good one to the extent it causes your 2024 state and local tax payments to exceed $10,000.

- Consider relocating your residency and domicile for the purpose of reducing or eliminating your state income tax. For example, common states where people move to reduce state income taxes are Florida, Texas, Wyoming, and Nevada.

- Consider increasing the amount you set aside for next year in your employer’s health flexible spending account (FSA).

- Consider contributing to a health savings account (HSA).

For 2024, individuals with a high deductible health plan can contribute $4,150 for self-only coverage and $8,300 for family coverage.

- If you’ve made any energy home efficient improvements you may be eligible for a tax credit. The credit applies to a wide range of home upgrades including insulation, windows, doors, and energy-efficient appliances.

- If you were in a federally declared disaster area, you may want to settle an insurance or damage claim in 2024 to maximize your casualty loss deduction. Confirmation regarding whether the damaged area is categorized by the IRS as a federal casualty loss or qualified disaster loss is important to avoid the 10% AGI limitation. A taxpayer can make an election to deduct a disaster loss in a federally declared disaster area for the year before the year in which the loss occurs.

A calendar-year taxpayer who suffers a disaster loss in 2024 has until October 15, 2025, to make this election to deduct the loss for 2024.

- If eligible, consider making a qualified charitable distribution (QCD) to support your favorite charities. A taxpayer can transfer up to $105,000 in 2024, which can help you reduce taxable income without itemizing. QCDs can also count towards your required minimum distributions (RMD). See the RMD section for more information.

- Donating to a donor-advised fund can be a strategic way to manage your charitable giving and accelerate your deductions.

- A 529 plan, also known as a qualified tuition plan, is a tax-advantaged savings plan aimed at encouraging savings for education expenses. These plans are sponsored by states, state agencies, or educational institutions, and contributions are treated as completed gifts for federal gift tax purposes. Although contributions are not federally deductible or limited, each state may have their own aggregate limits per beneficiary and allowable deduction.

- You may contribute up to $2,000 per beneficiary annually to a tax-exempt Coverdell Education Savings Account (Coverdell ESA) for individuals under 18 (or special needs beneficiaries of any age). The maximum contribution is gradually reduced for those with a modified AGI between $190,000 and $220,000 for joint filers and between $95,000 and $110,000 for others.

Capital Gain Planning

- Should I sell stocks/bonds now or wait for the new year? Capital gain rates are always top of mind, especially for those with substantial unrealized gains or business owners looking to sell their businesses. An increase in capital gain rates, even by a few percentage points, could make the difference between selling now or later.

- With the volatility of the market, many have seen a decrease in the value of their stocks. If there is a decision to sell loss stock in 2024, individuals should remember that capital losses can be used only to offset realized capital gain and an additional $3,000 of ordinary income each year.

- While individuals might be motivated to sell stock during 2024 to capture the capital loss and purchase the same stock at a lower cost, the wash-sale rule could apply. The wash-sale rule prohibits selling an investment for a loss and replacing it with the same or a “substantially identical” investment within 30 days before or after the sale. If you have a wash-sale, the loss will be deferred until the replacement investment is sold.

- The “wash sale” rule stops taxpayers from claiming a loss on the sale of stock or securities if they buy and sell substantially identical stock or securities within a 61-day window (30 days before or after the sale date). This means you can’t sell stock to create a tax loss and then repurchase it the next day. However, there are strategies to partially maintain an investment position while still realizing a tax loss, such as waiting to buy the same securities at least 31 days after sale or shift investments to similar securities in different companies in the same line of business.

- Donating appreciated stock to charity can be a smart tax strategy. When you donate stock that has increased in value, you avoid paying capital gains tax on the appreciation. Additionally, if you held the stock for more than one year, you can claim a charitable deduction for the full market value of the stock at the time of the donation, which can reduce your taxable income. This way, both you and the charity benefit more than if you sold the stock and donated the cash proceeds.

Tax-Advantaged Accounts

- It may make sense to convert all or part of your eligible retirement accounts (e.g., traditional IRA) to a Roth IRA before year-end. However, such a conversion may increase your AGI for 2024, and possibly reduce tax breaks that are tied to AGI (or MAGI).

- Consider taking versus delaying RMD from your IRA or 401(k) (or other employer-sponsored retirement plan).

- The IRS announced it will not impose penalties on failures to take specified RMDs for the 2024 taxable year in relation to inherited IRAs.

2024 Year-End Tax Planning Resources

Now’s the time to review your year-end tax planning options and strategies for the 2024 tax season. Withum’s Year-End Tax Planning Resource Center offers tips, legislative updates, and tax-saving opportunities for individuals and businesses.

Trusts and Estates

2025 Trust and Estate Income Tax Brackets and Rates

| If Taxable Income Is Between: | Your Tax Is: |

|---|---|

| $0 – $3,150 | 10% of the taxable income |

| $3,151 – $11,450 | $315 plus 24% of the excess over $3,150 |

| $11,451 – $15,650 | $2,307 plus 35% of the excess over $11,450 |

| $15,651 and above | $3,777 plus 37% of the excess over $15,650 |

2025 Trust and Estate Long-Term Capital Gains Tax Brackets

Trust and Estate Income Tax Planning

When comparing individual tax brackets and rates to those of trusts and estates, it’s apparent that trusts and estates reach the highest tax rates much quicker than individuals. Careful consideration should be paid to whether a distribution of income from an estate or a complex trust to a beneficiary would result in less total tax paid on the same income taxed at the individual level versus the estate or trust level. Distributions of income in this scenario would shift the income from being taxed on the estate or trust’s tax return to the individual tax return of the beneficiary receiving the distribution. If the beneficiary is in a lower tax bracket than the trust, this would result in overall tax savings.

Another planning opportunity surrounding trust distributions is utilization of the 65-day election under Section 663(b). This annual election allows a trust an additional 65 days after yearend to pay distributions to beneficiaries and report those distributions on the prior year’s tax return. This flexibility provides the opportunity to distribute the exact amount of income needed to optimize tax savings and can be paired with the point above regarding the tax brackets and rates to achieve the most favorable outcome for trusts and estates and their beneficiaries.

It’s important to note that the above strategies surrounding distributions apply to trusts that are taxed as complex trusts. Not all trusts are taxed as complex trusts – many estate plans incorporate irrevocable trusts taxed as grantor trusts, which offer the grantor the ability to be the owner of trust assets for income tax purposes but not for estate tax purposes. In this case, distributions would not carry out taxable income when paid to beneficiaries. For the reasons above and perhaps others (such as the grantor’s liquidity), it may be worth exploring whether a trust currently taxed as a grantor trust can be taxed as a complex trust in future years to take advantage of these planning opportunities.

Estate Planning

Estate tax continues to be a hot topic as the lifetime exemption continues to rise with inflation adjustments and is set to decrease in 2026.

- The current lifetime exemption is $13.61 million per person (and increasing to $13.99 million in 2025). If you have not done so already and are comfortable making transfers of assets to the next generation, it might be a good idea to take advantage of the $13.61 million per individual ($27.22 million for a married couple) lifetime exemption in 2024.

- AN IMPORTANT NOTE: The gift and estate tax lifetime exemption doubled with the passage of the Tax Cuts and Jobs Act, which is effective for tax years 2018 through 2025. The legislation was drafted so that the exemption will automatically decrease in 2026 absent any action from Congress. Those who are interested in making gifts and have sufficient assets to do so are encouraged to gift sooner rather than later; absent a change in tax law, the exemption amount is scheduled to decrease in 2026 to approximately $7 million per individual ($14 million for a married couple).

- For 2024, the gift tax annual exclusion limit is $18,000 per donor per donee. This is the amount that can be gifted from assets in your estate to an individual without triggering the gift tax or use of your lifetime exemption. Married couples can double the gift tax annual exclusion limit to $36,000 if they elect to split gifts on their gift tax returns or make gifts from their community property. Basic strategies surrounding use

of the gift tax annual exclusion that may or may not yet be included in your overall gifting plan to consider include:- Giving $18,000 to each of several family members, or $36,000 each between you and your spouse. These would be nontaxable gifts that would reduce your and your spouse’s gross estates.

- Front-loading 529 plans with up to five years of annual exclusion gifts of cash at once. For example, between you and your spouse, a one-time gift to a 529 plan could be made in 2024 totaling $180,000. However, this would limit annual exclusion gifts over the following five years to that plan’s beneficiary specifically.

- Forgive loans (such as intra-family loans or promissory notes) annually up to the amount of the annual exclusion.

Other strategies that do not use any gift/estate tax exemption are the direct payment of tuition and medical expenses and gifts to your spouse. Tuition and medical expense payments are not treated as a taxable gift and do not use any of your lifetime exemption amount as long as the payments are made directly to the educational or healthcare institution. These can be made on anyone’s behalf and are not limited to immediate family members. Additionally, gifts to a spouse, assuming you are both U.S. citizens, qualify for the unlimited marital deduction and are not subject to gift tax.

For those worried about giving away too much, Spousal Lifetime Access Trusts (SLATs) are worth considering. SLATs have become popular over the past few years due to their flexible terms and the increased lifetime exemption amounts. SLATs allow a donor-spouse to use a significant portion of their exemption by transferring assets to a trust while maintaining indirect access to the assets transferred through the beneficiary-spouse.

Planning in a High-Interest Rate Environment

Inflation and interest rates affect so many aspects of our lives – groceries, mortgages, business loans, and so forth – and we often forget that they affect our estate planning strategies as well. When the Federal Reserve increases the fed funds rate, there are usually increases to other rates, including the applicable federal rates (AFRs) and the section 7520 rate (the GRAT hurdle rate), both of which are integral parts of estate planning.

When interest rates are elevated, even slightly, we look for silver linings. Interest rate changes are particularly relevant for estate planning techniques that involve split gifts, like those made to qualified personal residence trusts (QPRTs), charitable remainder trusts (CRTs), and grantor retained annuity trusts (GRATs), as well as for more straight-forward transactions like intra-family loans. The popularity of split gifts in these environments is a product of the way a gift’s value is calculated, which is by taking the fair market value of the gift and subtracting the retained interest. In a high-interest rate environment, the value of the taxable gift is further reduced. If the taxable gift is lower, less exemption is used when making the gift.

QPRTs AND CRTs

With QPRTs, you transfer your home into a trust, retain the right to live in it for a specified period of time, and then gift that property to designated beneficiaries (usually children/family members) at the end of the QPRT term. Each piece of that split-interest gift is valued at the time the transfer is made. A higher interest rate means the value of the retained interest to live in the home is higher, which means that by default, the value of the remaining interest, or taxable gift, is lower. This is a tax-efficient way to keep a home in the family for generations.

Two important points surrounding QPRTs are choosing the appropriate term during which you retain the right to remain in the home, and whether you remain in the home after it passes to your beneficiaries. Should you pass away during the QPRT term, the value of the home is brought back into your estate, so careful consideration should be paid to how many years you choose for the QPRT term. You may also continue living in the home after it passes to your beneficiaries, but fair market value rent must be paid to the beneficiaries from that point on. Keep in mind that the payment of rent will remove assets from your gross estate.

With CRTs, you establish an income stream to a beneficiary for a defined period, followed by a gift to charity. The charitable deduction — the second part of the gift — is equal to the present value of the remainder interest passing to charity, meaning that the higher the interest rates, the higher the charitable deduction, which is a positive outcome for income tax purposes. It’s best to use low-basis assets with CRTs because you won’t recognize gain on the contribution, but the full fair market value will be used to compute the value of the income interest and the charitable deduction.

Intra-Family Loans and GRATs

Other useful strategies in rising rate environments include intrafamily loans and GRATs. These may also appeal to those who have used a significant portion of their lifetime exemption. With intrafamily loans, you make a loan to a family member using the AFRs set forth by the IRS. While AFRs are high, they’re typically lower than average mortgage rates, for example, so if you have a family member who needs liquidity, this could be a good solution.

GRATs are used to transfer appreciation in assets to named beneficiaries without the imposition of gift tax. They are particularly relevant for those who have used up their exemption amounts and are looking to transfer more wealth out of their estate. The grantor transfers an asset into a GRAT while retaining an annuity interest for a period of time, and to the extent that asset appreciates in value over the Sec. 7520 hurdle rate during that period, that appreciation passes to your beneficiaries gift tax-free. A common GRAT strategy is to establish short-term, rolling GRATs to mitigate mortality risks and avoid adverse effects of fluctuations in the GRAT asset values.

Sale to an Intentionally Defective Grantor Trust (IDGT)

Another strategy for those that may not have much of their lifetime exemption remaining is a sale to an intentionally defective grantor trust. This works much like a GRAT in that it’s a freezing technique where an appreciating asset is sold at the then-fair-market value to an irrevocable trust in exchange for an installment note. This becomes a transaction that is disregarded for income tax purposes and removes the future appreciation on the asset from the seller’s estate at minimal or even no gift tax cost. Typically, there is a “seed” gift to fund the trust up front of at least 10 percent of the sales price should the trust not have liquidity to facilitate the note.

Retirement Plans as Part of Your Estate Planning

Recent changes involving retirement plan accounts within an estate plan are significant enough that you may want to review your estate plan to be sure beneficiary designations still reflect the intended income tax consequences, especially if the account is left to a trust. The income tax consequences of these accounts may vary depending on the type of account and the type of designated beneficiary.

It is crucial to understand how these assets will be taxed for the recipient, especially when the recipient is a trust. The age of the decedent and the type of beneficiary (e.g., surviving spouse, trust, charity, etc.) will affect how quickly the accounts must be liquidated, and therefore taxed, when in the hands of the beneficiary.

The SECURE Act significantly affected the required minimum distributions, or RMDs, for a beneficiary that inherits a retirement plan account after January 1, 2020.

Certain inherited accounts will need to be fully depleted after 10 years, so timing and planning for these distributions for income tax and cash flow purposes is pivotal.

The estate and income tax consequences of these retirement accounts can make them an ideal asset to leave to a charity if you are charitably inclined. This shifts the income tax burden away from both your estate and your heirs to an entity not subject to income taxes.

Roth conversions have also become increasingly popular as the tax law has grown in complexity for these assets. A Roth conversion allows the taxpayer to convert a pre-tax account to an after-tax account so that the income tax liability is generated by the taxpayer before death. This strategy avoids income tax consequences for the estate or beneficiary and the payment of the tax by the taxpayer reduces their gross estate.

Required Minimum Distributions

There are a few things to keep in mind for retirement planning at year-end. RMDs, which begin at age 73 (except for Roth IRAs), are one consideration. There is a complex set of rules around when distributions from inherited IRAs must be taken, so beneficiaries should work with their Withum Wealth planners for the correct guidance.

RMDs are classified as ordinary income and can push individuals into a higher tax bracket for a particular calendar year. Those who do not need the income may consider making a qualified charitable distribution from their IRA. This allows charitably inclined individuals to direct up to $105,000 from their IRA each year (at age 70½ and older) to a public charity, reducing the RMD — and thus, taxable income — by that amount.

Contribution Limits

In 2024, the maximum amount that can be contributed to an employer-sponsored plan is $23,000, with a $7,500 catch-up contribution for those 50 and older. Beginning in 2025, there will be a special catch-up for those aged 60 to 63 for the greater of $10,000 or 150% of the regular catch-up amount in effect for the taxable year that is indexed for inflation.

For IRAs, the contribution limit for 2024 is $7,000, with a $1,000 catch-up contribution for those 50 and older. The deadline for 2024 IRA contributions is April 15, 2025. The contribution limit for 2025 remains the same — $7,000 per person with a $1,000 catchup contribution for those 50 and older.

Contact Us

For more information on this topic, reach out to Withum’s Private Client Services Team to discuss your individual situation as year-end approaches.

Disclaimer: No action should be taken without advice from a member of Withum’s Tax Services Team because tax law changes frequently, which can have a significant impact on this guide and your specific planning possibilities.