Projecting 2013 Tax Rates Amidst Election Year Uncertainty

With a lame duck session of Congress just two months away, it’s becoming increasingly possible that no new tax legislation will be passed before the end of the year. In the absence of any such legislation, tax rates are slated to change drastically effective January 1 with the expiration of the Bush tax cuts.

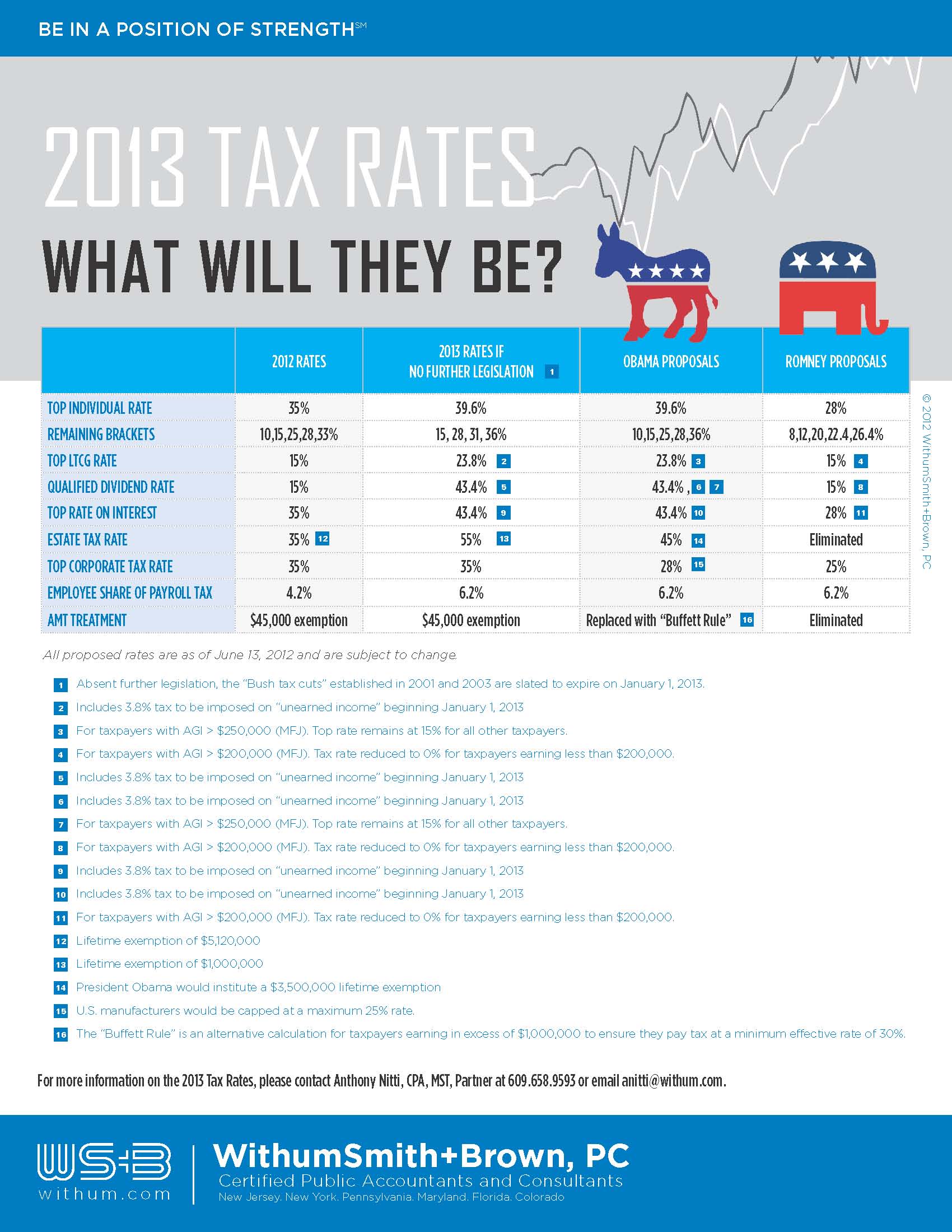

To aid in tax planning during this period of unprecedented uncertainty, we have prepared a comparison of key current tax rates to those tax rates that, barring any last minute legislation, will become effective on January 1, 2013, as well as further comparisons to the proposed rates both President Obama and Mitt Romney have vowed to enact should they win the presidency.

Please note, the potential rates listed for President Obama and Mitt Romney are not readily available on some campaign-sponsored website; rather, these rates have been culled from each candidates’ written proposals, campaign speeches, and in the case of President Obama, formal budget proposals. As a result, these rates are subject to varying interpretations based on whoever gathered them, so if you see a slightly different rate reported elsewhere, please don’t sic your lawyers on me. Finally, it’s also worth noting, these proposed rates are subject to change by November because — and you may want to sit down for this — politicians sometimes change their minds.

Attached is a PDF of the chart: Potential 2013 Tax Rates – September 2012

Below is a neat little picture. Click to enlarge.