The deadline for submitting the San Francisco Gross Receipts Tax return is quickly approaching on February 28, 2025. Before calculating the first quarterly payments for 2025, consider the changes enacted by voters in 2024 as part of Proposition M. A broad restructuring of the exemption threshold, apportionment formulas, and rates could considerably change your tax liability and estimates required for 2025.

The small business exemption threshold increased from $2.25 million to $5 million. Beginning in 2025, if San Francisco sourced gross receipts are less than $5 million, a current taxpayer will no longer be subject to the tax and no longer required to file a tax return with limited exceptions.

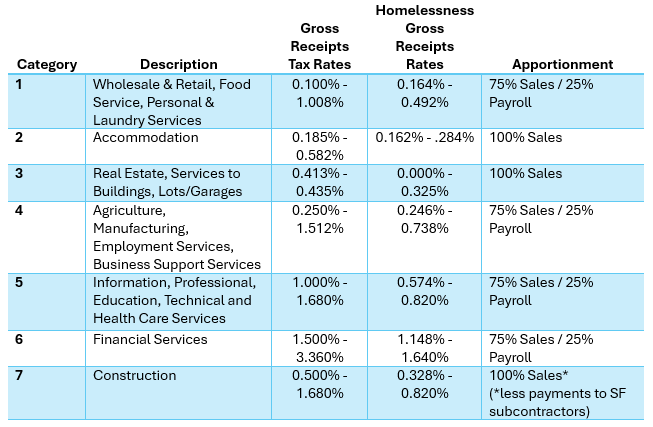

Included in Proposition M was a restructuring of the business classifications that determine the tax rate to be used by companies required to file. Previously, the city had businesses broken out into 14 categories. These categories have been simplified, and the rates adjusted. Businesses should confirm their NAICS code to determine the correct classification. The following chart shows examples of the general codes covered by each category and the tax rates for 2025-2026 for each.

The rates are progressive and depend on the total gross receipts allocated to San Francisco. They are scheduled to increase in 2027 and 2028.

The Homelessness Gross Receipts Tax (HGRT), an additional tax for larger businesses, will now apply to more Companies. Beginning in 2025, the exemption threshold for the HGRT has been lowered from $50 million to $25 million. The HGRT rates range from .1640% to 1.640% using the same entity classification as the gross receipts tax.

Over the last several years, San Francisco has transitioned from a payroll-based tax to a more heavily weighted gross receipts-based tax, using market sourcing concepts. Previous allocation factors used one of three methods: sales based on market sourcing (or where the benefit is received), payroll, or an evenly weighted combination of sales and payroll. It is possible that taxpayers who have benefited from a lower gross receipts tax due to employee presence being outside the city could see an increase in gross receipts tax due to the more heavily weighted sales factor. Industries that previously based their tax wholly on payroll within the city are also likely to see a shift in the tax base depending on where their customers are located.

Proposition M also introduces a new 110% safe harbor rule that extends the business tax filing by 9 months to November 30 if 110% of the previous year’s liability and registration fee is paid by the original due date of the return.

When completing the 2024 tax return, consider the new exemption thresholds, categories, tax rates, and sourcing requirements when calculating quarterly estimated payments (the first quarter due date is April 30).

Contact the state and local tax professionals at Withum to assist in reviewing your 2024 calculation and assessing whether you have a new filing requirement or are no longer required to file in 2025.

Authors: Rebecca Stidham, CPA, Partner | [email protected] and Penny Sweeting | [email protected]

Contact Us

For more information on this topic, please contact a member of Withum’s State and Local Tax Services Team.