Resist the Temptation to Overreact – Consider Sticking to Your Investment Plan

Unfortunately, this decision also requires a decision to reenter “when the markets have calmed down” or permanently exit the markets. If you miss just a few of the top performing days, it can significantly reduce your portfolio’s returns over time. Market timing is unpredictable- sometimes the best performing days occur in what appears to be a “big selloff.”

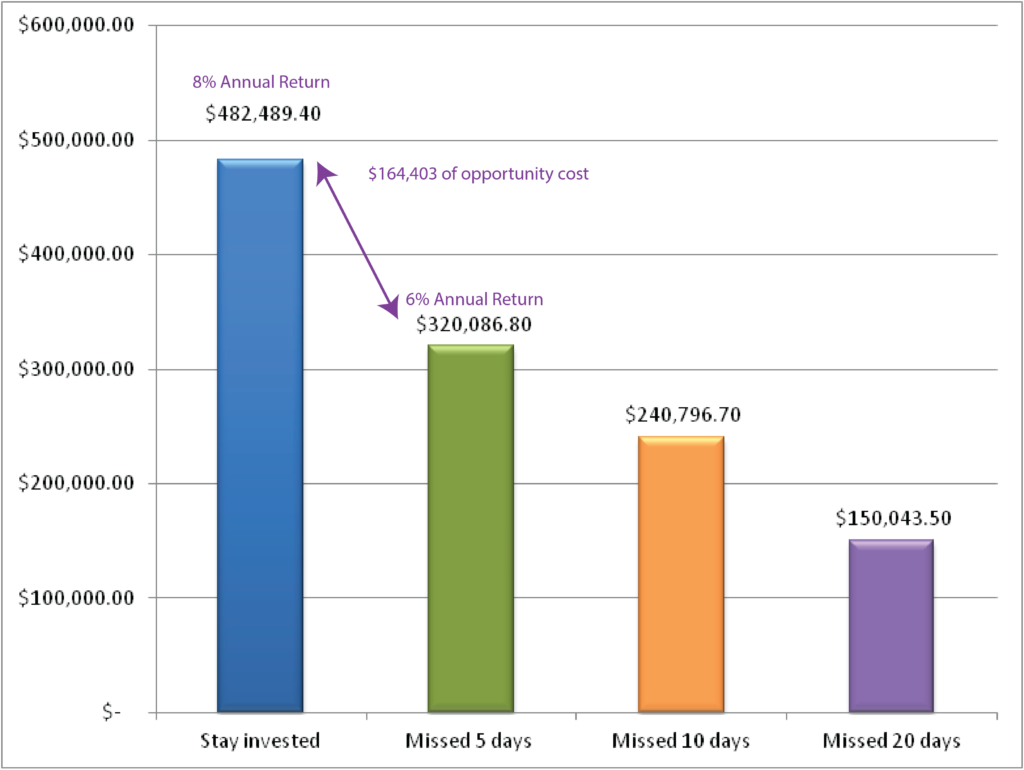

$100,000 investment in the S&P500

Adjusted for Missing “Best Days” (1/1/96-12/31/15)

For the investor who stayed the course, their annualized return for the 20 year period was 8.2% while the investor who missed the top five days would have only gained 6% on an annual basis. In dollar terms, that would have meant $162,403 of opportunity cost and a terminal value 34% below that of a “stay the course” investor. Consider sticking with a prudent investment plan.