When you are maintaining client funds in a trust bank account, a three-way reconciliation is required on a regular basis.

Three-Way Reconciliation: A Must-Know for Attorneys

Specifics vary from state to state; however, the basics remain the same:

- Managing and tracking client funds is required by the American Bar Association

- Detailed and accurate records of all activity occurring within the account should be retained

- Trust accounting involves administering, recording, and properly disbursing client funds. Law firms must follow their local Bar’s rules for handling client trust funds.

- It’s the attorney’s responsibility to ensure the reconciliation is being performed

The three-way reconciliation is a unique requirement for this type of account that all attorneys should be aware of and ensure their accounting team is performing this task on a regular cadence.

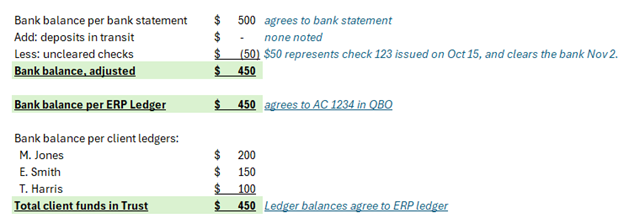

- Bank balance per bank statement

- Bank balance per the bank ledger (such as your QuickBooks Online account balance)

- Client ledger balance

These three balances may not always agree. However, there are acceptable reasons for that, which should be documented during the reconciliation process. For example, there may be an uncashed check, or a deposit in transit that is a “reconciling item.” Any reconciling item that doesn’t clear out within a reasonable time should be investigated. The reconciliation process should be documented along with the firm’s other accounting policies and procedures.

Three-Way Trust Reconciliation Example

Trust Account 1234, as of October 31, 202X

After the reconciliation is performed, supporting documentation should be attached, including reconciling items explanations, and stored for the minimum amount of time required by your jurisdiction.

Takeaways

Many accounting ERPs and legal case management applications can help facilitate some or all of the reconciliation process. Withum’s Outsourced Accounting Systems and Services (OASyS) Team can help you reconcile your accounts and develop a trust reconciliation process that works for you and your clients.

Contact Us

For more information on this topic, please contact a member of Withum’s Outsourced Accounting Systems and Services Team.