This article is the second installment of the tax policy comparison of Kamala Harris and Donald Trump, which aims to provide an unbiased and balanced perspective. We strive to present factual information and avoid any partisan bias. Our goal is to inform readers by highlighting the key aspects of each policy, allowing them to form their own opinions based on accurate and comprehensive data. We do not endorse or oppose any political figure or party. Our commitment is to neutrality and fairness, ensuring that our analysis is objective and based solely on the policies themselves.

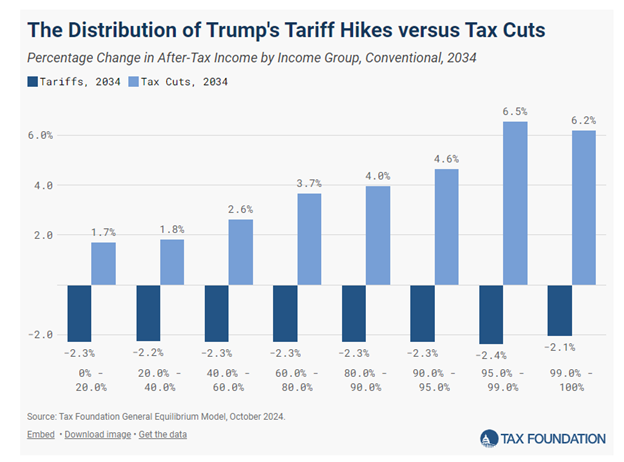

While President Trump’s tax proposals maintain many of the current provisions for individuals and businesses, the impact of the proposed tariff increases on the existing federal budget deficit, individual income taxpayers, and the global economy remains unclear. A recent study conducted by the Tax Foundation found that the Trump tax policy will provide a larger relative benefit to higher-income taxpayers, while his major proposed offset of higher import tariffs has a larger impact on lower—and middle-income taxpayers.

The Trump tax policy proposal makes many of the Tax Cuts and Jobs Act sunsetting provisions permanent, including the following:

| TCJA Expiring Provisions As of 12/31/2025 | Trump Proposal |

|---|---|

| Increase the top marginal individual income tax rate to 39.6% and adjust the individual income tax brackets. | Keep the top marginal individual income tax rate at 37% with no adjustment to the individual income tax brackets. |

| Lifetime Estate Tax Exemption will decrease from $13.61 million ($27.22 million for MFJ) to approximately $7.5 million ($15 million for MJF). | Provide that the increased lifetime estate tax exemption amount be permanent. |

| IRC Section 199A, 20% deduction for certain pass-through-owners will be eliminated. | Allow for the 199A deduction to be made permanent. |

| Reduce the AMT Phaseout and Exemption Amounts to pre-TCJA. | Make increased AMT Phaseout and Exemption Amounts permanent. |

In addition, the Trump tax proposal decreases the corporate tax rate from 21% to 20%and provides an additional decrease to 15% for manufacturing companies in the United States.

The Penn Wharton Budget Model projects the impact of the Trump tax policy provisions highlighted above to be $4,6 trillion over a ten-year period, while the Committee for a Responsible Federal Budget estimates that the same provisions could add $6,550 trillion to the budget deficit over ten years.

| Provision | Penn Wharton Projection | Committee for a Responsible Federal Budget Projection |

|---|---|---|

| Extend the individual income tax provisions of TCJA | -$3,388 | -$5,950 |

| Extend the business tax provisions of TCJA | -$623 | -$5,950 |

| Lower the corporate income tax rate to 15% | -$595 | -$600 |

| Deficit Impact Over Ten-Year Period | -$4,606 billion | -$6,550 billion |

In addition, President Trump’s tax policy proposal to exempt both overtime income and social security benefits from taxation is projected to add at least $2 trillion to the deficit, with a high estimate projection adding $4,5 trillion to the federal deficit over a ten-year period.

| Provision | Penn Wharton Projection | Committee for a Responsible Federal Budget Projection |

|---|---|---|

| Exempt Social Security Benefits from Income Tax | -$1,189.1 | -$3,000 |

| Exempt Overtime Pay from Income Tax | -$747.6 | -$1,450 |

| Deficit Impact Over Ten-Year Period | -$1,936.7 | -$4,450 |

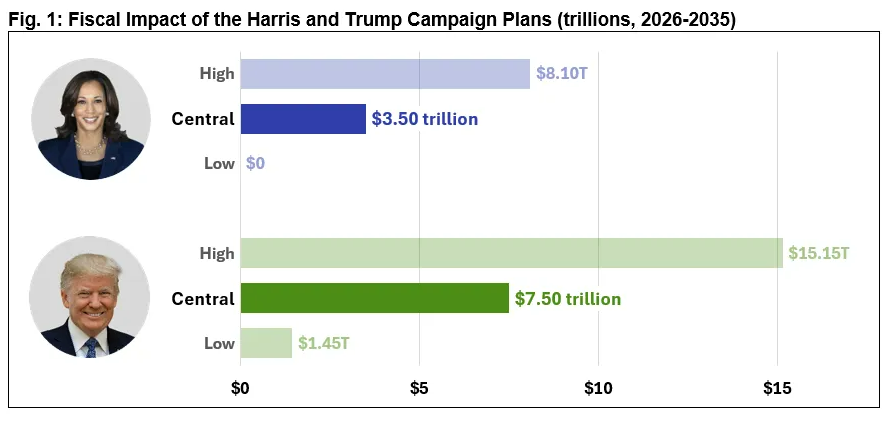

Overall, the Committee for a Responsible Federal Budget projects that the Trump Tax and Spending plan will increase the federal deficit between $1.45 and $15.5 trillion, while the Harris Tax Policy proposals are estimated to increase the deficit between $0 and $8.1 trillion.

Get the Latest Tax and Legislative Developments

Withum’s National Tax Policy and Legislative Updates Resource Center is the go-to hub for the latest changes in tax laws and legislative developments from Washington, D.C. Our team closely monitors and analyzes proposed tax legislation, providing individuals and businesses with timely insights to help navigate the evolving tax landscape.

While a story in the October 14 WSJ gaming out tax policy indicated that if Republicans win the House, Senate, and Presidential election, Senate Finance Ranking Member Mike Crapo’s (R-ID) view that extending TCJA provisions expiring at the end of 2025 shouldn’t be offset with a revenue raiser, there are Republicans who resist increasing the deficit due to tax policies without including offsetting revenue. Senator Thom Tillis (R-NC) has stated that any “non-pro-growth” policies should be paid for.

The most significant revenue raiser included in the Trump tax policy proposals is the imposition of a universal baseline tariff of 10% to 20% on all U.S. imports and a 60% tariff on all U.S. imports from China. The estimated revenue raised from such a proposal would be between $2-$4,3 trillion.

A tariff is a domestic tax levied on goods as they enter the country, proportional to the value of the import. The charge is paid by the domestic company that imports the goods, not the foreign company that exports them. Over the course of 2023, the U.S. imported around $3,1 trillion of goods, equivalent to around 11% of U.S. GDP.

While individuals may not be expecting federal income tax increases under the Trump tax policy proposal, the increase in tariffs is expected to impact consumers’ after-tax income, as many expect the increased tariffs will be passed on to U.S. customers.

In a recent study performed by the Tax Foundation, it was estimated that the Trump policy extending TCJA provisions while increasing tariffs would cause the bottom 40% of households to see tax increases. The after-tax income would fall by 0.6% for the bottom quintile and 0.4 percent for taxpayers in the 20th to 40th percentile. Middle-income taxpayers would see very slight tax cuts on average, with after-tax income increasing by 0.3 percent in 2034. The top two quintiles would see the largest increases in after-tax income, ranging from 1.4 percent for taxpayers in the 60th to 80th percentile to 3.1 percent for the top quintile. Increases for the top 1 percent are even larger, reaching 4.1 percent in 2034.

In total, the Tax Foundation estimates that the proposed tariff increase would reduce long-term GDP by at least 0.8 percent, the capital stock by 0.7 percent, and hours worked by 684,000 full-time equivalent jobs. The Tax Foundation estimates do not capture the effects of retaliation or the additional harms in the event of a global trade war.

An increase in the federal deficit would require an increase in the national debt. While debt would continue to grow faster than the economy under either candidate’s plans, it is estimated by the Tax Foundation study that Vice President Harris’s plan would grow the debt between 125% to 144% of GDP in 2035, while President Trump’s proposal will increase the debt between 128% to 160% of GDP in 2035. The highest percentage to GDP ratio currently on record is 106%, during the time of World War II in 1946.

Coupled with an increase to the deficit is growing net interest expense. For the first time in our nation’s history, interest outlays on the federal debt will surpass defense outlays this year, and would continue under the Trump Proposal. The Committee for a Responsible Federal Budget has estimated net interest to rise to $2.05 trillion (a $150 billion increase) under the Trump proposals. However, the Harris proposal’s projected net interest impact is estimated to be between $0 to $1.2 trillion.

| Presidential Policies | Trump | Harris |

|---|---|---|

| Debt | $1,450 – $15,150 billion | $0 – $8,100 billion |

| Net Interest Expense | $150 – $2,050 billion | $0 – $1.2 billion |

While the individual income tax impact of extending the Tax Cuts and Jobs Act expiring provisions may be clear, the impact that increased tariffs could have on individual after-tax dollars and the federal deficit remains uncertain.

Tune In!

Listen to ourTaxing Topics: Navigating Election Year Podcast Series! In this episode, we delve into the intricacies of Donald Trump’s tax policy. Join us as we explore the key components of the Tax Cuts and Jobs Act, its effects on different income groups, and the broader economic implications. We’ll also discuss the political and social debates surrounding the policy.

Contact Us

For more information on this topic, please contact a member of Withum’s Business Tax Services Team.