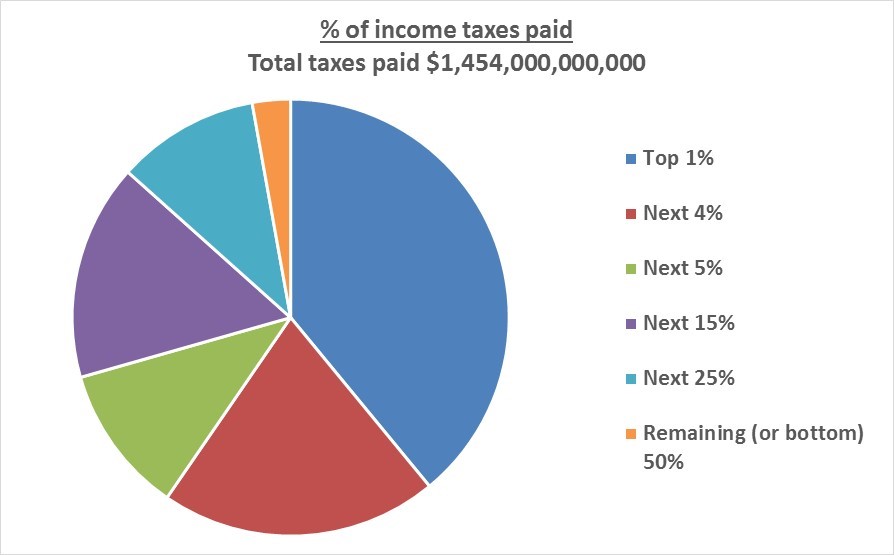

Who pays the income tax

Today is tax day so is a likely time to see who pays the income tax. The most recent available data is for 2015 and was compiled by the Tax Foundation and is subject to their copyright. Here is a link to their full report: (https://files.taxfoundation.org/20180117125609/Tax-Foundation-FF570.pdf).

In 2015 there were 141,204,625 individual tax returns filed. The following chart does not include dependent filers. By way of perspective, the top 1% filed 1,412,046 returns and paid 39.0% of the income tax. The bottom 50% filed 70,602,313 returns and paid 2.8% of the income tax.

The top 1% paid $567,697,000,000 and the bottom 50% paid $41,125,000,000. This is income tax and does not include FICA and Medicare taxes which are paid by employees and their employers and the self-employed, and other federal taxes such as corporate, excise and estate taxes.

I hope you find this info as interesting as I did.

How Can We Help?