The corporate tax rate for C corporations is currently a flat 21% rate. There is also a 15% corporate alternative minimum tax (CAMT) based on book income for companies with average annual adjusted financial statement income exceeding $1 billion.

In contrast, S corporations and partnerships generally are not subject to tax and their items of income, gain, deduction and loss pass through to their shareholders/partners. S corporations and partnerships also may qualify for the 20% deduction applicable to qualified business income under section 199A, which was made permanent under the OBBBA.

Limits on Deduction of Business Interest

Every business, regardless of its form, is generally subject to a disallowance of a deduction for net interest expense in excess of 30% of its adjusted taxable income (ATI). The interest expense limitation is applied at the partnership level but flows through to the partners and reduces the partner’s outside basis in their partnership interest. The interest expense limitation is applied at the C and S corporation levels, remaining at the entity level until excess taxable income can be generated to utilize interest previously disallowed.

The OBBBA provides relief under the interest expense limitation rules by expanding the definition of ATI to include depreciation, amortization and depletion for taxable years beginning after December 31, 2025. Thus, the 30% deduction limitation will be applied to a larger base of ATI.

In addition, for taxable years beginning after December 31, 2025, the OBBBA also states that interest expense capitalization rules apply both to business interest expense and business interest that was capitalized under an interest capitalization provision. Therefore, as an example, the OBBBA requires both business interest capitalized in inventory, as well as business interest that is an ordinary deduction, to be combined when assessing the interest expense limitation rules.

Exemptions from the Limitation on Business Interest Deductions

- An exception from these rules applies to taxpayers (other than tax shelters) with average annual gross receipts for the three-year tax period ending with the prior tax year that do not exceed $31 million for taxable years beginning in 2025.

- Real property trades or businesses can elect out of the provision, but they must use the alternative depreciation system (ADS) to depreciate nonresidential real property, residential rental property and qualified improvement property (and ADS generally has longer recovery periods than MACRS). Any asset with a class life of less than 15-years can still be depreciated using MACRS and take advantage of bonus depreciation.

- An exception from the limitation on the business interest deductions is also provided for floor plan financing (i.e., financing for the acquisition of motor vehicles, boats, or farm machinery for sale or lease and secured by such inventory). However, the required utilization of floor plan financing to avoid the interest expense limitation rules does negatively impact the ability of the taxpayer to utilize bonus depreciation for that year.

- Expansion of small businesses that are able to use the cash (as opposed to accrual) method of tax accounting. To qualify as a small business, a taxpayer must, among other things, satisfy a $31 million gross receipts test discussed above. For the 2026 taxable year, the gross receipts test threshold is increased to $32 million. Cash method taxpayers may find it easier to shift income between tax years, e.g., by deferring billings until next year or by accelerating expenses such as paying bills early.

NOTE: If a taxpayer can meet the small business gross receipts test, other advantages include not being required to follow the uniform capitalization (UNICAP) rules, being allowed to utilize a simplified method to track inventory and not being required to utilize the percentage for completion method for long-term contracts.

- Consider making expenditures that qualify for the liberalized business property expensing option.

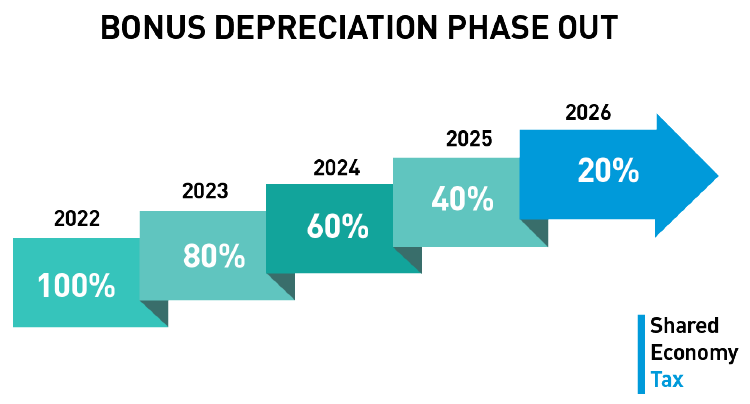

Bonus Depreciation

For qualified property placed in service on or after January 19, 2025, 100% bonus depreciation has been reinstated. However, a taxpayer can elect to apply the 40% bonus depreciation instead of the 100% rate, for the first taxable year ending after January 19, 2025.

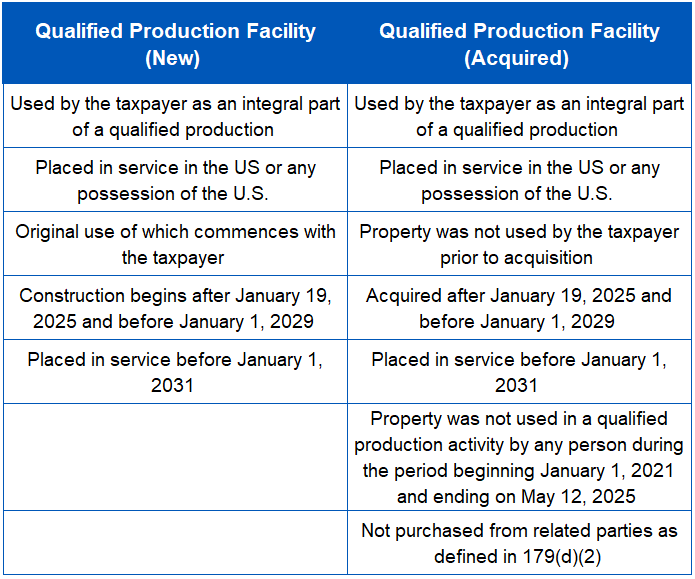

New Real Property Expending for Qualified Production Property

The OBBBA provides taxpayers with an election to take 100% bonus depreciation for new or newly acquired non-residential real property manufacturing facilities. Qualified production activity includes the manufacturing, production or refining of a qualified product when substantial transformation takes place.

Section 179 Expensing

Section 179 allows taxpayers to completely expense qualified assets in the year of purchase, instead of having to depreciate them over time. The total section 179 deduction for taxable years beginning in 2025 is $2,500,000 (increased from $1,220,000 in 2024). In addition, the amount of section 179 deduction is reduced by the amount of section 179 property placed in service for taxable year beginning in 2025 that exceeds $4,000,000 (increased from $3,130,000 in 2024). Therefore, no deduction under section 179 is allowed for a taxpayer who placed into service more than $6,500,000 of section 179 property in the 2025 taxable year.

- Expensing is generally available for most depreciable property (other than buildings), off-the-shelf computer software, and business-use vehicles (though restrictions apply).

- Expensing is also available for “qualified improvement property” (generally, any interior improvement to a building’s interior, but not for enlargement of a building, elevators or escalators or the internal structural framework), as well as roofs, HVAC, fire protection, alarm and security systems.

- The expensing deduction is not prorated for the time that the asset is in service during the year. Thus, property acquired and placed in service in the last days of 2025, rather than at the beginning of 2026, can result in a full expensing deduction for 2025.

- Section 179 expensing, unlike bonus depreciation, can give rise to state income tax benefits.

Section 179D Expensing

The energy-efficient commercial buildings deduction under section 179D provides taxpayers with an incentive to make certain commercial building properties more energy efficient, including improvements to interior lighting, HVAC and water systems, windows and roofing. Section 179D provides additional opportunities for taxpayers, including as much as $5.81 per square foot (sq. ft.) in the 2025 taxable year in immediate deductions to encourage the construction of energy-efficient buildings. Due to the Inflation Reduction Act of 2022, there is an opportunity for energy-efficient retrofits of older buildings to become eligible for the deduction. In addition, taxpayers who design buildings owned by governmental entities, tax-exempt organizations and Indian tribal governments could also benefit because those entities are now able to allocate the section 179D deduction to the person “primarily responsible” for the design. Unlike section 179, there is no limitation based on the amount of assets placed in services.

The OBBBA made a significant change to section 179D by eliminating the ability to claim the deduction for new energy-efficient commercial buildings for property beginning construction after June 30, 2026.

De Minimis Safe Harbor Election

Also known as the book-tax conformity election, this election offers an administrative convenience that allows businesses to deduct small-dollar (i.e., up to $2,500 or $5,000 per invoice) expenditures for the acquisition or production of property that otherwise would have to be capitalized, other than amounts paid for inventory or land. The election must be reflected for financial accounting purposes or the books and records of the company as well.

Cost Segregation Benefits

Cost segregation is a strategic tax savings tool that allows companies and individuals who have purchased, constructed, expanded or remodeled any kind of real estate to immediately increase their cash-flow by accelerating their depreciation deductions and deferring their federal and state income taxes. Cost segregation is recognized as an engineering-based tax study accepted by the IRS. The primary goal of cost segregation is to identify, segregate and reclassify the various building-related assets away from either nonresidential real property (39 years) or residential rental property (27.5 years) to a shorter depreciable tax life (e.g., 3, 5, 7, 15 or 20 years). The reclassification of these assets into the shorter depreciable tax lives allows you to take an immediate deduction, either 40% or bonus depreciation, in 2025. Therefore, if you are planning any type of real estate transaction, the time to act is now!

Other Cost Segregation Services include:

- Look-back studies to recapture depreciation deductions from prior tax years without amending your tax return.

- Repair and maintenance studies.

- Section 179D studies relating to energy-efficient commercial buildings.

- Purchase price allocation studies.

Income Acceleration and Estimated Tax Payment Planning

Certain corporations (other than large corporations) that anticipate a small net operating loss (NOL) for 2025 and substantial net income in 2026 may find it worthwhile to accelerate just enough of their 2026 income (or to defer just enough of their 2025 deductions) to create a small amount of net income for 2025. This will permit the corporation to base its 2026 estimated income tax installment payments on the relatively small amount of income shown on its 2025 tax return, rather than having to pay estimated taxes based on 100% of its much larger 2026 taxable income.

- Consider whether to elect into bonus depreciation for the 2025 taxable year and review de minimis safe harbor capitalization policies.

- Model the implications of the increased interest expense limitation rules and impact of expensing previously capitalized domestic research and experimental (R&E) expenditures from the 2022, 2023, 2024 taxable years.

- Review compensation plans to avoid accelerated deduction.

- Consider deferring a debt cancellation event until 2026 to reduce 2025 taxable income.

- Consider disposing of passive activity in 2025 if doing so will allow you to deduct suspended passive activity losses to reduce 2025 taxable income. Consider electing out of installment sale treatment or avoid like-kind exchange transactions.

Your Tax Strategy Simplified

With recent tax policy changes, individuals and businesses should take proactive steps now to maximize deductions and minimize liabilities. Withum’s Tax Planning Resource Center provides timely insights, planning tips and compliance reminders tailored to your needs.

Employee Retention Tax Credit (ERC)

- The time period to file new ERC claims has expired. The IRS remains active in auditing Q3 and Q4 2021 claims that were paid, and in denying all or part of 2020/2021 claims that remain unpaid.

- The OBBBA made several changes to the ERC. Two of the changes include:

- (i) extending the statute of limitations for claims relating to Q3 & Q4 2021 from three years to six years (generally).

- (ii) preventing the payment of claims relating to Q3 and Q4 2021 if such claims were filed after January 31, 2024, and not paid by the IRS before January 5, 2025.

Research and Experimental (R&E) Expenditures

The OBBBA enacted Internal Revenue Code (“IRC”) Section (“§”) 174A, which allows for domestic R&E to immediately be deductible for taxable years beginning after December 31, 2024. This is a significant change from IRC §174, which required domestic R&E to be capitalized over a five-year period for taxable years beginning after December 31, 2021. Based on the OBBBA modifications made to IRC §174, §174A and §59(e), taxpayers can now choose to:

- Immediately deduct domestic R&E expenditure for taxable years beginning after December 31, 2024.

- Elect to capitalize domestic R&E expenditures and be allowed an amortization deduction of such expenditures ratably over a period of not less than 60 months beginning with the month in which the taxpayer first realizes benefits from such expenditures.

- Elect to capitalize R&E expenditures and deduct the expenditure ratably over 10 years.

It is important to note that the requirement to capitalize foreign R&E under IRC §174 and amortize the costs over 15 years remains.

As part of the transition relief provided in Revenue Procedure 2025-08, the OBBBA allows for all taxpayers to deduct any remaining unamortized R&E amounts incurred in taxable years after December 31, 2021, and before January 1, 2025, in the tax year ending December 31, 2025, taxable year (for calendar year taxpayers) or deduct the remaining unamortized amount ratably over December 31, 2025, and December 31, 2026 (for calendar year taxpayers). This is an election by the taxpayer, and the taxpayer can instead choose to allow the domestic R&E capitalized amounts incurred in taxable years after December 31, 2021, and before January 1, 2025, to continue being amortized over the remaining five-year amortization period required under IRC §174.

Alternatively, a small business is provided the opportunity to amend their 2022, 2023 and 2024 federal income tax returns to immediately expense domestic R&E that was previously capitalized. A taxpayer is considered a small business taxpayer if their average annual gross receipts for the 2024, 2023 and 2022 taxable year are $31,000,000 or less. An election to amend requires all three years to be amended and taxpayers who claimed a research and development credit in those years must access Section 280C. Before amending, analysis should occur regarding the impacts of the amendment including Section 382 limitations and Section 461(l) excess business loss limitations.

Proper analysis as to the treatment of previously capitalized 174 R&E expenditures should take place to ensure optimal utilization of the deduction by allowing for the full deduction in the taxable year it is claimed and limiting the amount of the deduction subject to net operating loss limitations.

1% Stock Buyback Excise Tax

The Inflation Reduction Act of 2022 included a provision requiring covered corporations to pay a 1% tax on the fair market value of any corporate stock that they redeem after December 31, 2022. A covered corporation is a domestic corporation that has stock traded on an established securities market. The definition of a covered corporation could apply to domestic special purpose acquisition companies (SPACs).

Although the deadline for completing reporting and payment obligations related to the excise tax was delayed, the IRS issued final regulations on June 28, 2024, providing guidance on how to report and pay the 1% tax. These final regulations require that the stock repurchase excise tax be reported on Form 720, Quarterly Federal Excise Tax Return, due for the first full calendar quarter after the end of the corporation’s taxable year, with the Form 7208, Excise Tax on Repurchase of Corporate Stock. Forms 720 and 7208 due for taxable years ending after December 31, 2022, and on or before June 30, 2024, must be filed by the third quarter due date for Form 720, which is October 31, 2024.

Section 1202 Stock

For certain C corporations satisfying an active trade or business requirement, shareholders who hold original issuance stock for more than five years can be eligible to have gain on the sale of such stock excluded from tax to the extent of the greater of $10 million or 10 times their original tax basis.

The OBBBA made three important changes that expand the benefits and scope of the exclusion, but the changes apply only to stock issued on or after July 5, 2025. The first change allows for a tiered gain exclusion instead of a single five-year holding period, allowing access to the exclusion before five years. The new law allows for a 50% exclusion if the stock is held at least three years, a 75% exclusion if held for at least four years and a 100% exclusion if held for at least five years. The second change increases the cumulative per-issuer gain limit from $10 million to $15 million, indexed for inflation beginning in 2027. The third change increases the gross asset threshold from $50 million to $75 million, indexed to inflation beginning in 2027.

Contact Us

For more information on this topic, reach out to Withum’s Business Tax Services Team to discuss your situation as year-end approaches.

Disclaimer: No action should be taken without advice from a member of Withum’s Tax Services Team because tax law changes frequently, which can have a significant impact on this guide and your specific planning possibilities.