Withum’s Corporate Value Consulting Services Team provides business valuation loan reports in conjunction with the Small Business Administration’s (SBA) 7(a) loan program. Our experienced team oversees the analysis and correspondence between the proposed buyer, seller, and lender throughout the loan valuation process and ultimately delivering the final report. As a provider of business valuations for commercial litigation, mid-market transaction advisory, and small business succession planning, our experience and knowledge span across different industries and all purposes. Our strong working relationships with accounting, tax, and financial regulatory authorities help ensure a level of expertise, experience, and knowledge otherwise unavailable previously to the SBA community.

What is the SBA 7(a) program?

The SBA 7(a) program is the SBA’s primary program for providing financial assistance to small businesses. While the loan can be used for a variety of purposes, the standard 7(a) loan program allows for a maximum of $5 million in financing which can be used for the purposes of abusiness acquisition.

The SBA does not directly lend to small businesses or potential acquirers. Instead, it provides a guarantee on a portion of the loan which is funded by an SBA-approved lender. The SBA has a Preferred Lenders Program (PLP) that provides lenders with the ability to make the final credit decision. Nonpreferred lenders are required to send loans and the extensive documentation associated with the loan to the SBA for approval.

Under the 7(a) program, lenders are required by the SBA’s Standard Operating Procedures (SOP) to obtain a business valuation for business acquisitions that result in goodwill exceeding $250K or if the transaction is entered into by two related parties such as business partners, employee/employer, or family members. Our express engagement process delivers SBA SOP compliant reports within three to seven business days

How We Can Help

- Prompt SBA SOP turnaround time to meet your deadlines (3-7 business days!)

- Market competitive pricing

- Access to Capital IQ, Bloomberg, Economic Research Institute, IBIS World, and other subscription services for market and industry data

- Unique industry expertise due to Withum’s depth and breadth of services and experts

- No geographical limitations

- Accredited professionals in accordance with the requirements in the SOP

- Final report certified and signed by a CPA

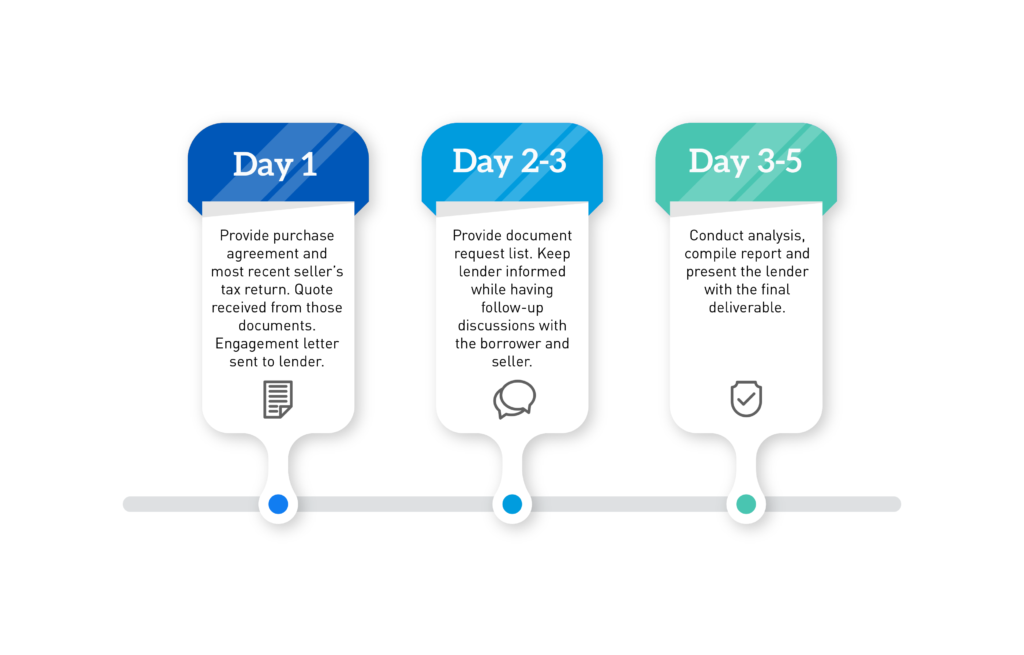

Express Engagement Process

We understand how important it is to provide our reports to SOP lenders in a timely manner without sacrificing the quality of the deliverable. Due to our years of experience and innovation on large and complex engagements, we are able to provide our SBA valuation reports within 3 to 7 business days. Typical business valuation for SBA purposes will be executed under the following process:

Leadership

Featured Insights

Unpacking an Industry: FedEx Routes

Contracted FedEx routes are a popular business that aspiring entrepreneurs often seek to acquire using financing from SBA 7(a) loans. FedEx routes present a business opportunity to leverage an established […]

Reliance on Interim Financials in SBA Business Valuations

A common challenge when completing a business valuation for SBA 7(a) purposes is how much reliance should be given to the seller’s interim financial statements. Generally, an SBA lender will […]

Business Valuation: The Impact of Real Estate Ownership and Rent Adjustments

Typically, when performing a business valuation for SBA 7(a) purposes, the prospective buyer is seeking to purchase both the business and its underlying real estate from the seller. In these […]