Whether you are a buyer or seller, we offer flexible transaction advisory services throughout the M&A lifecycle. We know that every deal is different and tailor our approach to the unique aspects of your transaction, including the target’s industry, complexity and size, as well as your plans and goals to realize value from the transaction.

Our Firm’s deep ties to the middle market and our national dedicated team’s industry-leading knowledge come together in your deal team to put you in a Position of Strength. Withum’s Transaction Advisory Team works closely with our industry teams and global network in domestic and cross-border deals across a wide range of industry sectors.

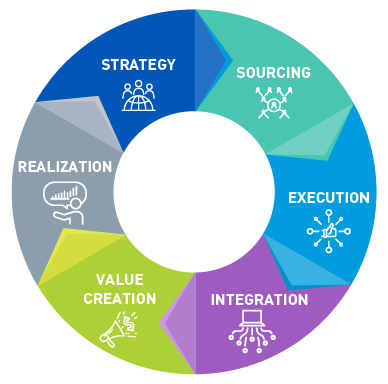

We’ll Be Here Through the Lifecycle of the Deal

We have the expertise and experience to advise you throughout the deal cycle – strategy, transaction readiness, deal execution, integration, value creation until realizing the returns on your investment of time, effort and capital.

Sourcing

- Target Screening

- Strategic Fit Assessment

- Financial Modeling

Integration

- Integration Planning and Project Management

- Purchase Price Allocation

- Working Capital Adjustment

- Finance and Accounting Outsourcing

- IT Integration and Upgrades

- Cybersecurity

- Data Analytics and Dashboard Reporting

- Change Management

Realization

- Sell-Side Financial Due Diligence

- Sale Readiness

- Transaction Tax Structuring

- Wealth Management

- Exit Planning

- ESG Planning

Execution

- Buy-Side Financial Due Diligence

- Tax Due Diligence and Structuring

- Operational Due Diligence

- Cybersecurity Due Diligence

- IT Due Diligence (Systems and Software)

- HR Due Diligence

Value Creation

- Performance Improvement

- Technology Improvement

- Assurance and Accounting

- Tax

- Supply Chain Improvement

- Process Reengineering

Our Approach

Projects are actively led by partners and industry experts, ensuring you receive the highest quality analysis and advice.

Our transaction advisory team has years of deal experience with access to over 1,200 Withum professionals having expertise in a variety of industries and specializations to bring added value to your transaction.

Every transaction is unique, which is why we work with you to customize the scope of work for each engagement working with the deal team through open, real-time communication.

Our main goal is to identify the critical value drivers in the deal, communicate the risks & opportunities we discover, and then provide practical advice to manage the transaction to allow deals to close and companies to thrive.

We understand that deals develop at a fast pace. Our professionals are driven, responsive and quick to react to new developments and changing deal dynamics.

Take a Seat at The Capital Table

Listen to our M&A podcast, The Capital Table, as leading experts dive into the private equity and M&A worlds, and provide you with the knowledge you need to excel in a rapidly changing marketplace.

Contact Us

For more information or to discuss your business needs, please connect with a member of our team.

Leadership

Featured Insights

The Capital Table – Insights into the Private Equity and M&A World

Start Exploring Latest Podcast Episode In this episode of The Capital Table, Steve Brady, Market Leader of Transaction Advisory at Withum, speaks with Travis Loomis, Senior Manager, Advisory Lead, Operations & Supply […]

The Benefits of Financial Due Diligence in M&A Transactions for Multi-Unit Franchise Operators

Mergers and acquisitions (M&A) involving multi-unit franchise operations requires a meticulous approach to ensure a successful transaction. Potential buyers will need to understand all facets of the business on an […]

M&A Empow’her’ment – Spotlighting the Women in the M&A World

Introducing M&A Empow'her'ment, a groundbreaking video series dedicated to empowering and celebrating women's achievements in the dynamic world of M&A.